When evaluating blockchain networks for real-world deployment, especially in areas like decentralized finance (DeFi), gaming, and enterprise solutions, two technical metrics stand out: block time and transaction finality. These parameters directly impact user experience, security, and the design of applications. The ongoing debate of Monad vs Ethereum block time is more than theoretical; it’s a practical comparison that shapes how developers choose their infrastructure.

Block Times: Speed as a Competitive Edge

Ethereum, the most widely adopted EVM chain, has a block time of approximately 12 seconds. This means that new blocks – and thus new sets of transactions – are added to the chain every 12 seconds. While this interval was a breakthrough at launch, it now represents a bottleneck for high-throughput applications. With current throughput limited to about 10-15 transactions per second (TPS), congestion and rising fees can be persistent issues during periods of high demand.

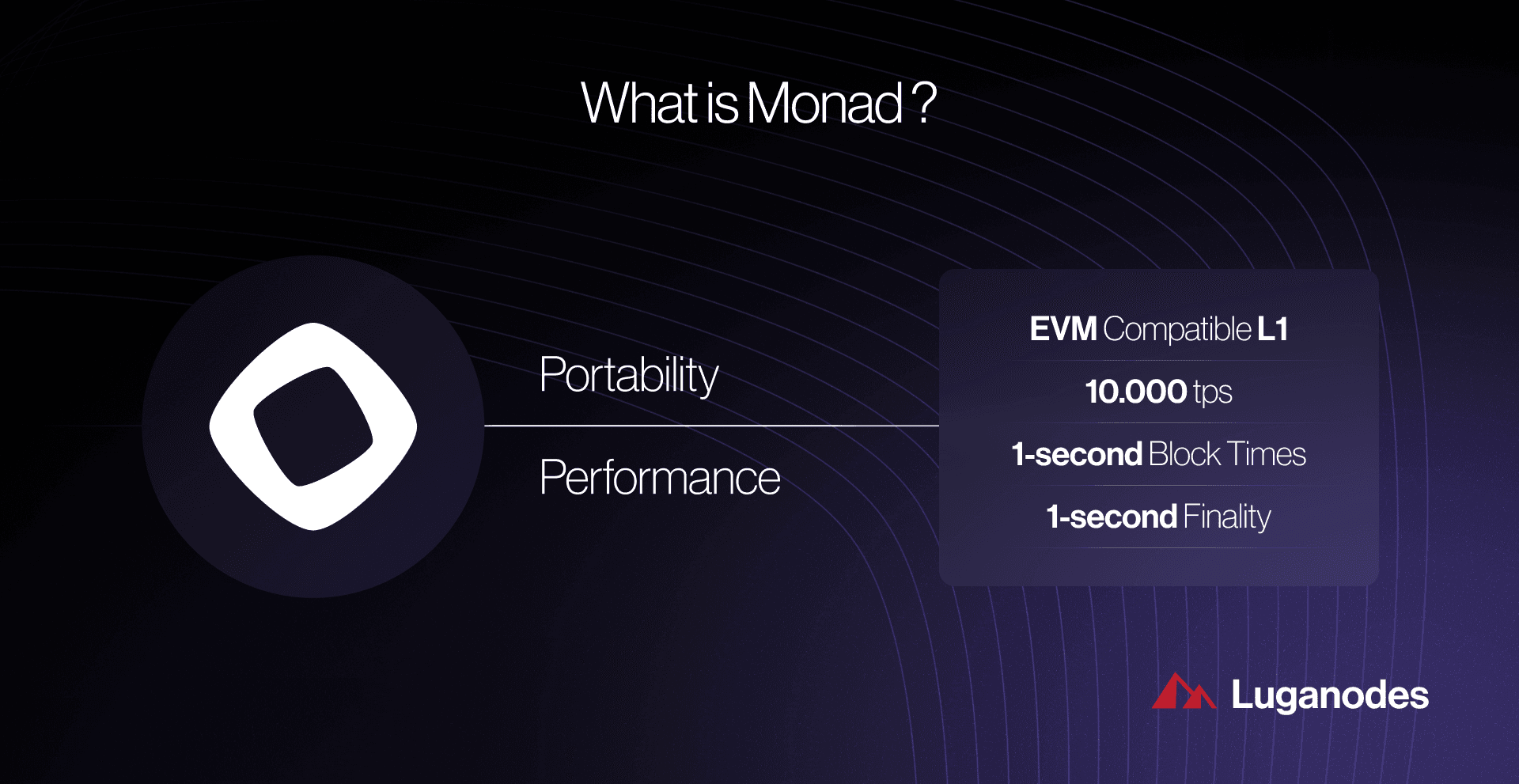

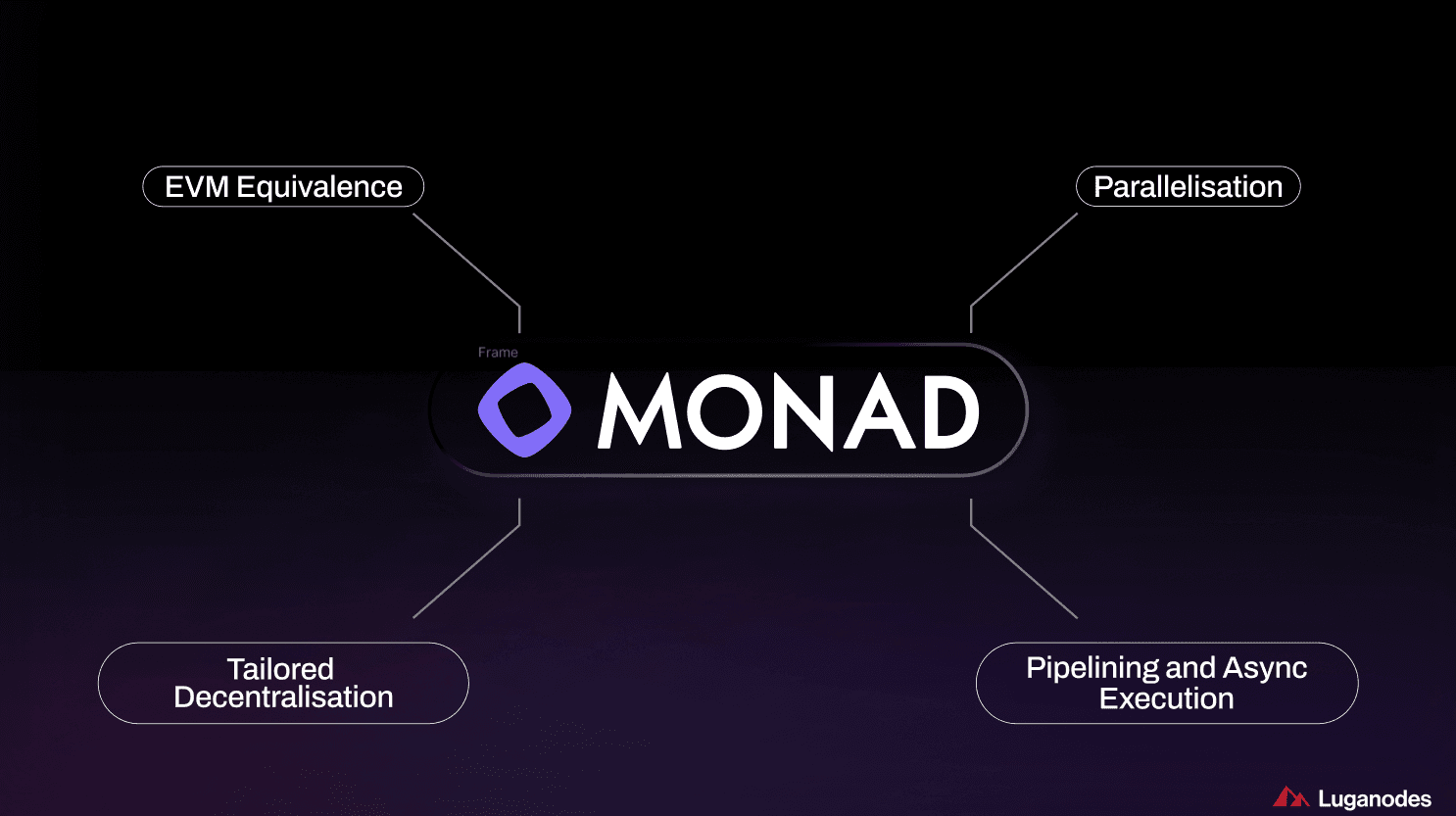

Monad, by contrast, is engineered for speed. Its consensus mechanism, MonadBFT, enables block times as low as 1 second. In practice, this means that transactions can be included in the ledger up to twelve times faster than on Ethereum. For real-time applications, think on-chain trading platforms or interactive games, this reduction in latency is transformative.

Finality: Rethinking Irreversibility and Security

The concept of finality refers to when a transaction becomes irreversible, a crucial factor for businesses handling sensitive or high-value operations. On Ethereum today, finality typically takes between 15-20 minutes (64-95 slots), as blocks must pass through multiple validation epochs before being considered permanent. This window allows for the detection of malicious activity but also introduces uncertainty and friction into user flows.

Monad’s single-slot finality flips this paradigm on its head. In Monad’s architecture, transactions reach finality within roughly one second, the same duration as its block interval, thanks to streamlined validator communication and deferred execution strategies (source). For end-users and enterprises alike, this means near-instant settlement with minimal risk of rollbacks or double-spending attacks.

Transaction Latency Comparison: Real-World Implications

The difference between 1-second and 12-second block times isn’t just academic, it defines which use cases are feasible on each platform. Applications requiring rapid feedback loops or microtransactions benefit enormously from Monad’s architecture:

- Real-time DeFi protocols: Faster trades and liquidations with lower slippage risk.

- On-chain gaming: Smoother gameplay with immediate action resolution.

- Enterprise data processing: Near-instant confirmation supports workflows where delays are costly or unacceptable.

The tradeoff? While Monad delivers speed through aggressive parallelization and asynchronous processing (source), Ethereum’s longer finality period is often seen as providing an extra layer of security, a feature valued by institutions managing large sums or sensitive data.

Ethereum (ETH) Price Prediction 2026-2031

Professional ETH price outlook based on current market data, technology trends, and competitive landscape (starting at $4,462.80 in 2025)

| Year | Minimum Price | Average Price | Maximum Price | % Change (Avg. YoY) | Market Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $3,900 | $5,250 | $6,800 | +17.6% | Adoption grows; ETH 2.0 upgrades continue, but competition from fast L1s like Monad increases. |

| 2027 | $4,300 | $6,200 | $8,200 | +18.1% | Layer-2 rollups and staking expand; regulatory clarity improves, offset by new L1 entrants. |

| 2028 | $4,800 | $7,150 | $10,000 | +15.3% | Ethereum strengthens dominance in DeFi/NFTs; Monad and others push innovation, keeping fees competitive. |

| 2029 | $5,100 | $8,000 | $12,500 | +11.9% | Macro bull cycle and institutional adoption; potential for ETH ETF approval increases upside. |

| 2030 | $5,400 | $8,900 | $15,000 | +11.3% | ETH matures as digital asset; real-world use cases (RWAs) expand, but scaling pressure remains. |

| 2031 | $5,000 | $9,800 | $17,500 | +10.1% | ETH seen as blue-chip crypto; competition from Monad/Solana keeps innovation high, but network effects remain strong. |

Price Prediction Summary

Ethereum is expected to maintain its leading position as a smart contract platform, with steady price growth driven by adoption, network upgrades, and increasing institutional interest. However, emerging competitors like Monad, offering faster block times and finality, could pressure Ethereum to accelerate innovation. Price volatility will persist, but the long-term trajectory remains positive, especially if Ethereum successfully integrates further scalability and usability improvements.

Key Factors Affecting Ethereum Price

- Competition from high-performance EVM-compatible chains like Monad and Solana

- Continued roll-out of Ethereum scaling solutions (Danksharding, L2s)

- Regulatory clarity in major markets (US, EU, Asia)

- Growth in DeFi, NFTs, and tokenized real-world assets (RWAs)

- Institutional adoption and possible ETH ETF approvals

- Macro market cycles and global economic conditions

- Potential for new use cases leveraging Ethereum’s security and composability

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

EVM Chain Comparison at Current Market Levels

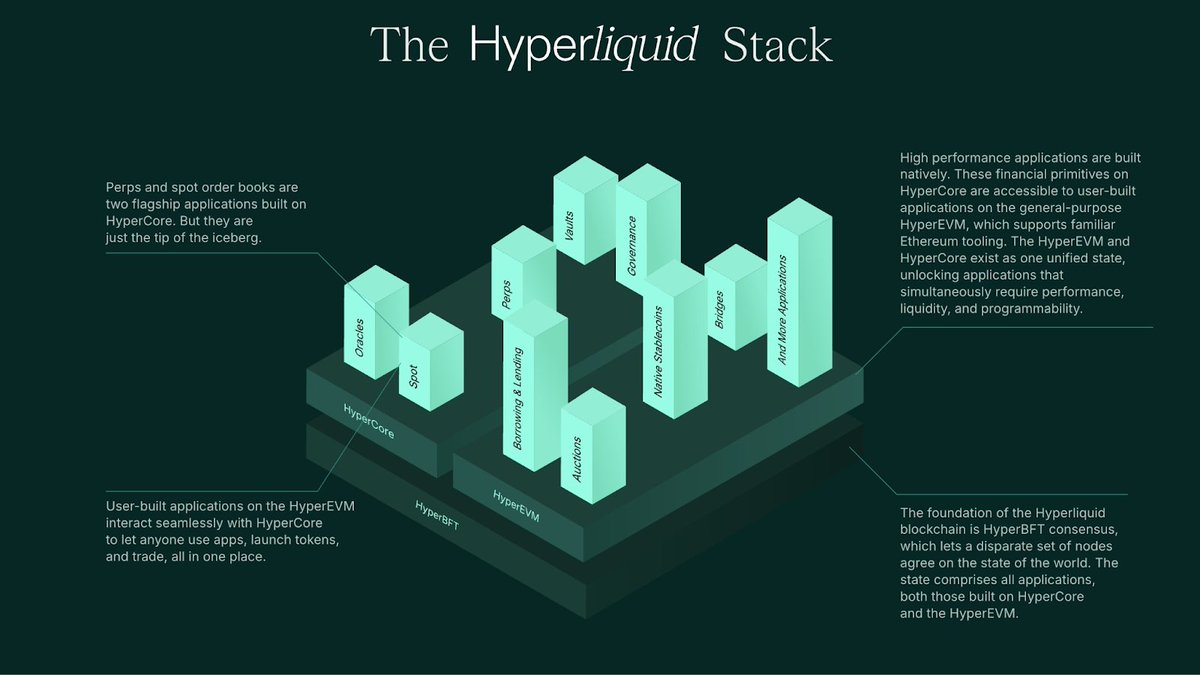

This technical divergence comes at a time when Ethereum trades at $4,462.80, reflecting its dominance but also its scaling limitations (source). As developers look beyond legacy constraints toward next-generation performance benchmarks like Monad’s 10,000 TPS ceiling and low hardware requirements, the question shifts from “Is faster better?” to “What does faster enable?” The answer lies in unlocking entirely new classes of decentralized applications that were previously impractical due to network latency or cost constraints.

For projects that demand high throughput and responsiveness, Monad’s 1-second block times and single-slot finality are not just incremental improvements, but foundational shifts. These capabilities enable use cases such as decentralized exchanges (DEXs) with sub-second trade settlement, NFT platforms with real-time minting and transfers, and cross-border payments that rival the speed of traditional fintech rails. The ability to process up to 10,000 transactions per second without sacrificing EVM compatibility means that developers can port existing Ethereum dApps or build entirely new applications without rearchitecting for a different execution environment.

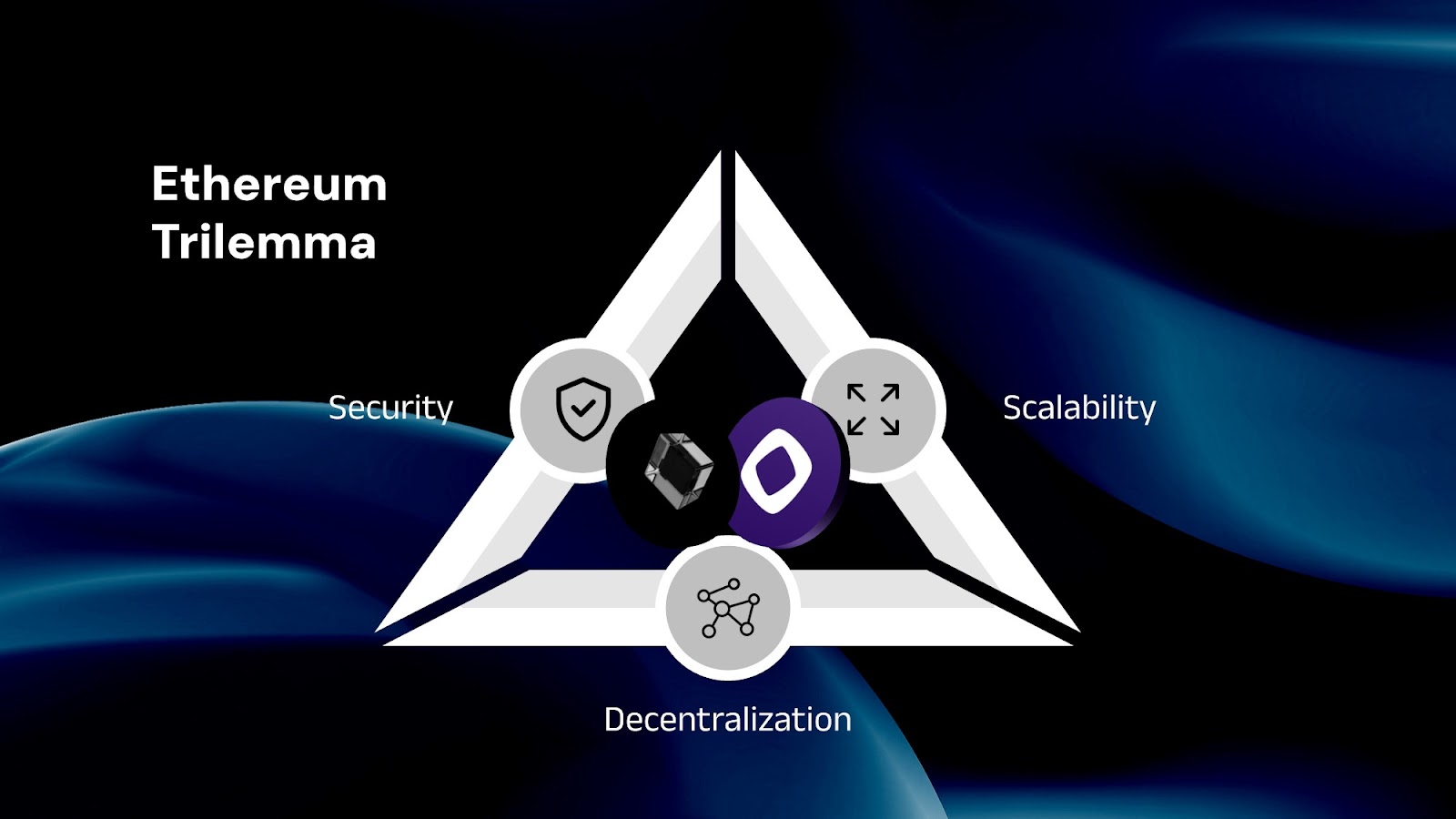

At the same time, it’s important to recognize the tradeoffs inherent in any blockchain design. Ethereum’s longer finality window is not a flaw so much as a deliberate choice to maximize security in an adversarial environment. This makes it especially attractive for high-value DeFi protocols, institutional asset management, and scenarios where the cost of a rollback or double-spend would be catastrophic. Monad’s approach optimizes for speed and efficiency while maintaining robust consensus through MonadBFT.

Key Takeaways for Developers and Enterprises

Key Differences: Monad vs. Ethereum for Builders

-

Block Time: Monad achieves ~1 second block times, enabling near-instant transaction inclusion. Ethereum processes blocks every ~12 seconds, resulting in slower transaction confirmations.

-

Finality: Monad offers single-slot finality, with transactions finalized in about 1 second. Ethereum requires 64–95 slots (about 15 minutes) for finality, due to its consensus mechanism.

-

Transaction Throughput: Monad supports up to 10,000 transactions per second (TPS) thanks to parallel execution. Ethereum handles 10–15 TPS, which can lead to congestion during high demand.

-

Network Efficiency: Monad leverages parallel and asynchronous processing for greater efficiency and lower fees. Ethereum‘s sequential execution can result in higher gas costs during congestion.

-

Security and Maturity: Ethereum is a well-established, battle-tested platform with a large developer ecosystem and robust security. Monad is newer but offers advanced performance features, making it attractive for speed-critical applications.

If you’re evaluating which EVM chain best fits your product roadmap, consider these practical questions:

- How sensitive is your application to transaction latency? For anything requiring sub-second response, such as on-chain gaming or high-frequency DeFi, Monad’s architecture provides a clear advantage.

- What are your security requirements? If absolute certainty against chain reorganizations is paramount, Ethereum’s established network effect and longer finality may be preferable.

- What is your anticipated transaction volume? High-volume apps will benefit from Monad’s parallel execution model and low hardware requirements, reducing operational costs over time.

The landscape of EVM-compatible blockchains is rapidly evolving. As market participants weigh the benefits of Monad’s technical innovations against Ethereum’s proven track record (with ETH currently priced at $4,462.80), the calculus will increasingly center on real-world performance rather than theoretical throughput alone.

The Future of Transaction Latency: Innovation or Security?

The push toward instant settlement and ultra-low latency is more than a race for numbers, it signals a shift in what’s possible for decentralized applications. As more enterprises seek blockchain solutions that match or exceed Web2 user experiences, chains like Monad set new expectations for speed without abandoning EVM compatibility or developer tooling familiar from Ethereum.

This does not mean Ethereum will be sidelined; rather, it highlights how specialization within the EVM ecosystem can unlock new markets. For some sectors, especially those where milliseconds matter, Monad offers a compelling platform to build next-generation dApps that were previously out of reach due to technical bottlenecks.

The decision between Monad and Ethereum ultimately hinges on your application’s needs: whether you value the battle-tested security model at current ETH prices ($4,462.80) or require the bleeding-edge speed that only single-slot finality can deliver. In either case, understanding these core differences empowers teams to make informed choices as they architect tomorrow’s blockchain-powered solutions.