Validator economics are the backbone of any high-performance blockchain, dictating both network security and long-term sustainability. On Monad, a next-generation EVM-compatible chain, validator incentives and churn mechanics are engineered to maximize throughput, minimize risk, and align economic rewards with honest participation. This article explores how Monad’s validator economics create a resilient environment for developers and enterprises seeking scalable infrastructure.

Incentive Structures: How Monad Rewards Validators

At the core of Monad’s Proof-of-Stake (PoS) system is a robust incentive mechanism. Validators must stake MON tokens as collateral to participate in transaction validation and block proposal. In return, they earn newly minted MON tokens, with rewards distributed proportionally based on both staked amount and performance efficiency. This design encourages validators to operate honestly and maintain high uptime, as slashing penalties apply for malicious behavior or downtime.

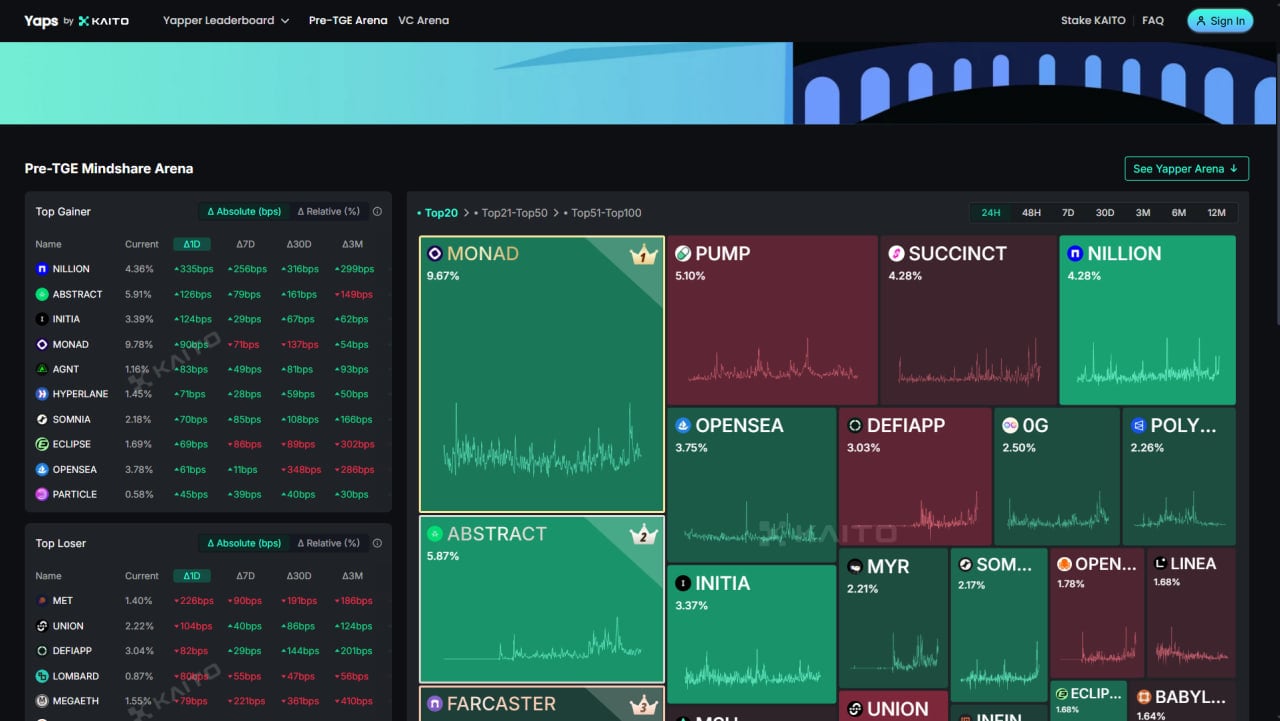

Unlike legacy chains where validator rewards can be volatile or skewed toward large players, Monad’s architecture supports a large validator set. This reduces reward variance across participants, promoting fairness and decentralization. As seen in other PoS systems like Ethereum, increasing the number of active validators leads to more consistent yields, a principle that Monad amplifies through its parallelized EVM execution layer.

Managing Validator Churn: Stability Through Design

Validator churn, the rate at which validators join or exit the active set, directly impacts network health. Excessive churn can destabilize consensus or open attack vectors; too little churn may lead to centralization. Monad addresses these risks with mechanisms such as cooldown periods and daily unbonding request limits. These features prevent rapid cycling of stake in and out of the system while ensuring that new validators have regular opportunities to onboard.

This careful balance is critical for maintaining network health. By controlling churn rates, Monad supports a resilient validator ecosystem that is both secure against coordinated attacks and flexible enough to adapt to changing market conditions.

Key Factors Shaping Validator Economics on Monad

-

Staking Incentives and Rewards: Validators on Monad stake MON tokens as collateral and earn rewards in newly minted MON tokens, proportional to their staked amount and performance. This structure incentivizes honest and efficient participation.

-

Validator Churn Management: Monad employs mechanisms such as cooldown periods and daily unbonding request limits to regulate validator entry and exit. These controls help maintain network stability and prevent destabilizing fluctuations in validator participation.

-

MonadBFT Consensus Protocol: The network uses MonadBFT, a high-throughput, low-latency consensus mechanism based on the HotStuff algorithm. This protocol enables rapid block finalization and supports a large validator set, enhancing scalability and fault tolerance.

-

Validator Set Size and Decentralization: A larger number of validators on Monad enhances decentralization, security, and resilience against attacks. The reward distribution model encourages wider participation by reducing reward skewness as the validator set grows.

Consensus Participation and Network Robustness

The technical foundation of Monad’s validator set is the MonadBFT consensus protocol, an optimized variant of HotStuff tailored for high throughput. Validators engage in a two-phase commit rule designed for rapid finality without compromising security or fault tolerance. This protocol enables support for thousands of concurrent validators, unleashing parallel execution while maintaining Byzantine fault tolerance.

The result is an EVM chain capable of handling real-world DeFi scale without bottlenecks or latency spikes commonly seen on traditional networks. For developers deploying on Monad, this means predictable confirmation times even during peak activity, a crucial factor for user experience in dApps where every millisecond counts.

Another important innovation in Monad’s validator economics is the integration of liquid staking protocols such as Magma and Kintsu. These platforms allow users to stake their MON tokens and receive liquid derivatives (e. g. , gMON, sMON) in return. These tokens can be freely traded or used in DeFi applications while still accruing staking rewards. Liquid staking not only increases capital efficiency for token holders, but also broadens the base of network participants, further decentralizing security and reducing the risk of validator concentration.

From a quantitative perspective, Monad’s approach to validator incentives is engineered for equilibrium. The reward curve is designed to scale with both the total amount staked and validator performance, ensuring that rewards remain attractive enough to incentivize honest participation but are not so high as to encourage excessive risk-taking or centralization. As the number of validators grows, yield variance decreases, promoting a more stable reward environment and making it easier for smaller operators to participate competitively.

Validator Churn: Metrics and Market Impact

Churn management on Monad is more than a technical safeguard; it’s a direct lever on market dynamics. By limiting daily unbonding requests and enforcing cooldown periods, Monad reduces sudden shocks to network security that can occur during periods of market volatility or price swings. These features protect against coordinated exits that could undermine consensus or expose the network to short-term attacks.

For institutional participants and enterprise validators, predictable churn parameters translate into lower operational risk. Stakeholders can plan around known exit windows and onboarding schedules, which is especially important for entities managing large pools of delegated capital or running automated trading strategies atop Monad’s parallelized EVM layer.

Sustaining Network Health Through Economic Design

Monad’s validator economics are ultimately about sustaining long-term network health by aligning incentives at every level, from individual stakers to professional operators. The combination of robust slashing conditions, fair reward distribution, managed churn, and liquid staking creates a feedback loop where security, decentralization, and usability reinforce one another.

This holistic approach positions Monad as a leading EVM chain for high-throughput applications where reliability cannot be compromised. As other networks struggle with either centralization risks or throughput bottlenecks, Monad demonstrates how careful economic engineering can unlock both scalability and security without trade-offs.

“Decentralized networks live or die by their incentive structures. Monad’s validator model shows what’s possible when you optimize for fairness and resilience at Internet scale. ”