Decentralized finance (DeFi) has pushed blockchain networks to their limits, exposing the bottlenecks of traditional sequential processing. As the ecosystem matures, the demand for high-throughput, low-latency blockchains is no longer aspirational – it’s a hard requirement. Monad, a high-performance EVM-compatible Layer 1, is purpose-built to address these needs, introducing a parallel execution architecture that redefines what’s possible for DeFi DApps.

Why Sequential EVM Processing Limits DeFi Growth

Ethereum’s EVM standard has catalyzed a wave of innovation, but it comes with a critical tradeoff: transactions are processed one after another to preserve state consistency. This approach, while robust, caps throughput at around 10-15 transactions per second and leads to congestion, especially during market volatility or popular launches. High fees and slow confirmations have become the norm, constraining DeFi’s ability to scale and serve mainstream users.

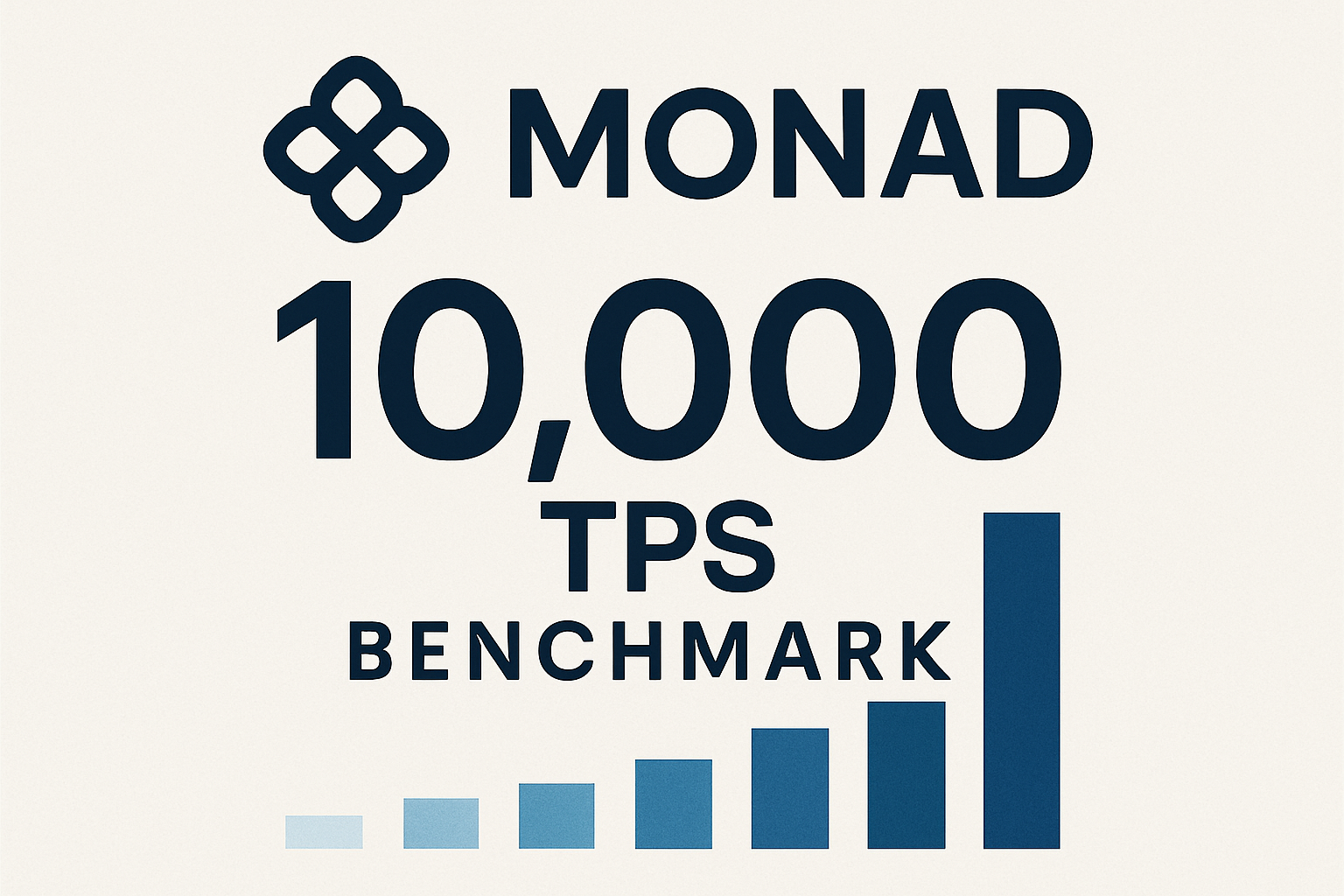

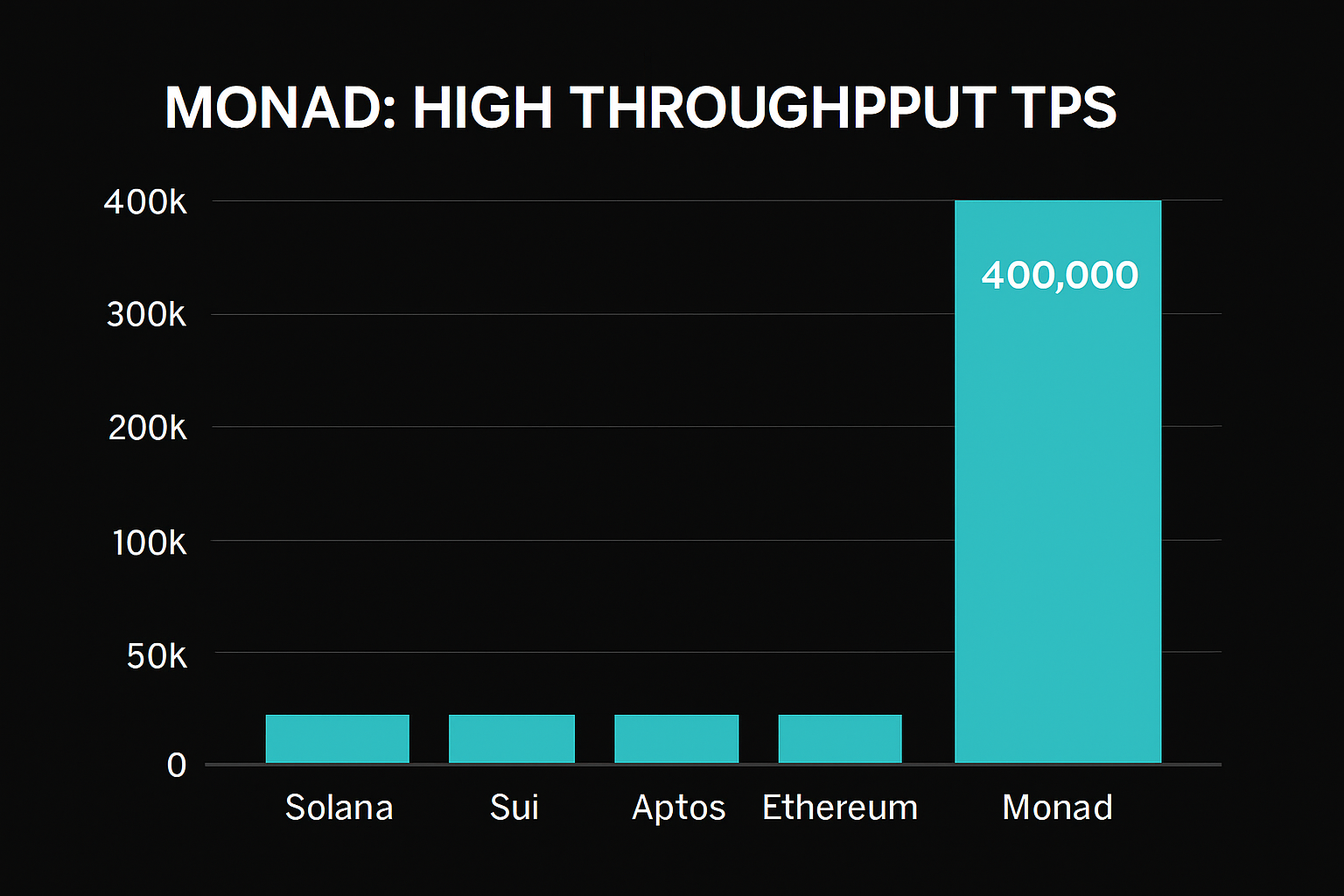

Monad’s architecture directly tackles these limitations by introducing EVM parallelization. Instead of treating every transaction as a potential conflict, Monad analyzes dependencies and executes non-overlapping transactions simultaneously. The result? A dramatic increase in transaction throughput, with Monad achieving up to 10,000 TPS – a quantum leap compared to Ethereum and most EVM chains.

How Monad EVM Parallelization Works Under the Hood

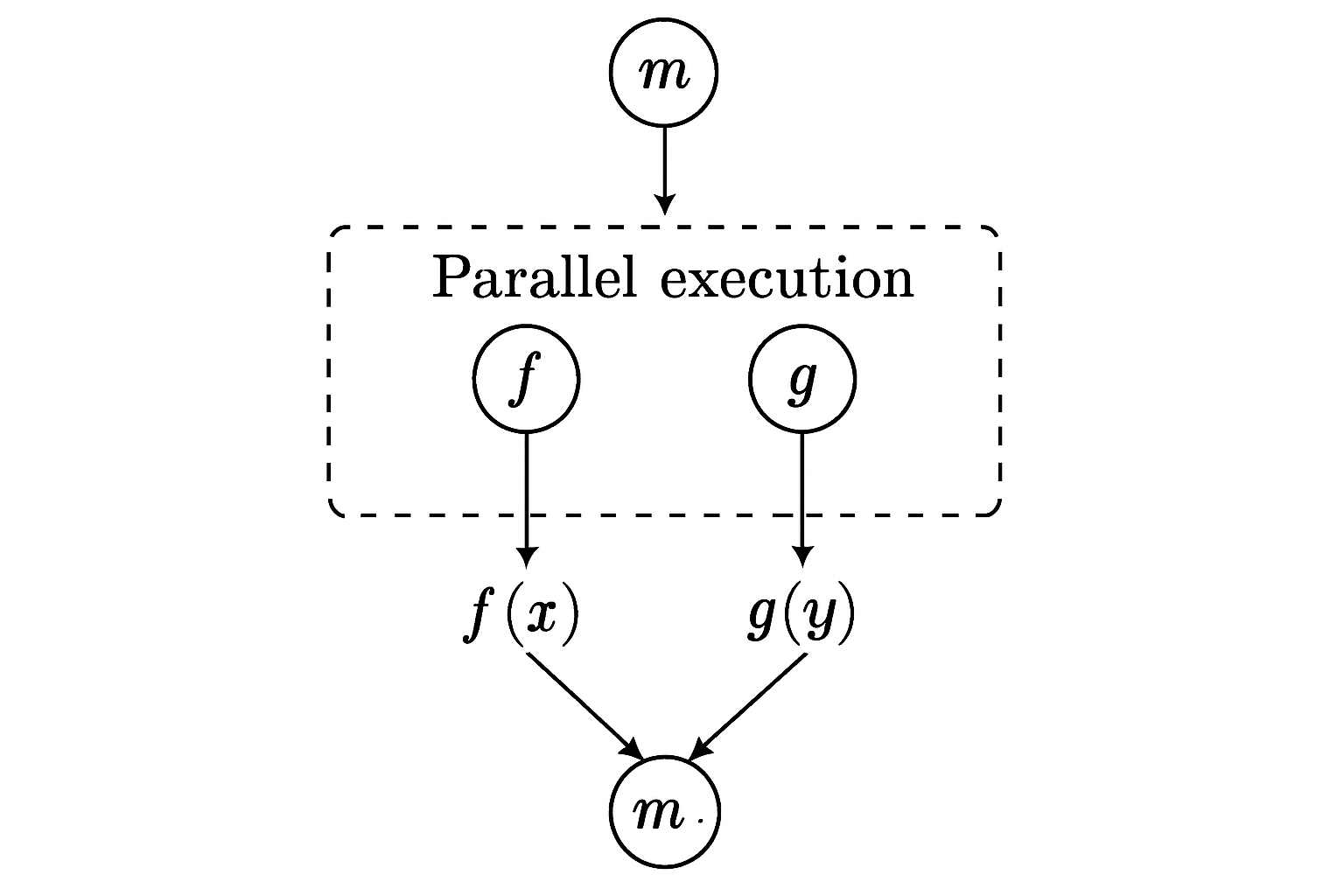

At the heart of Monad’s breakthrough is its ability to untangle transaction dependencies before execution. The protocol constructs a dependency graph, mapping which transactions interact with which accounts or contracts. If two transactions touch entirely separate parts of the blockchain state – say, different liquidity pools or user wallets – they’re routed for concurrent execution. Only transactions that could potentially conflict are sequenced.

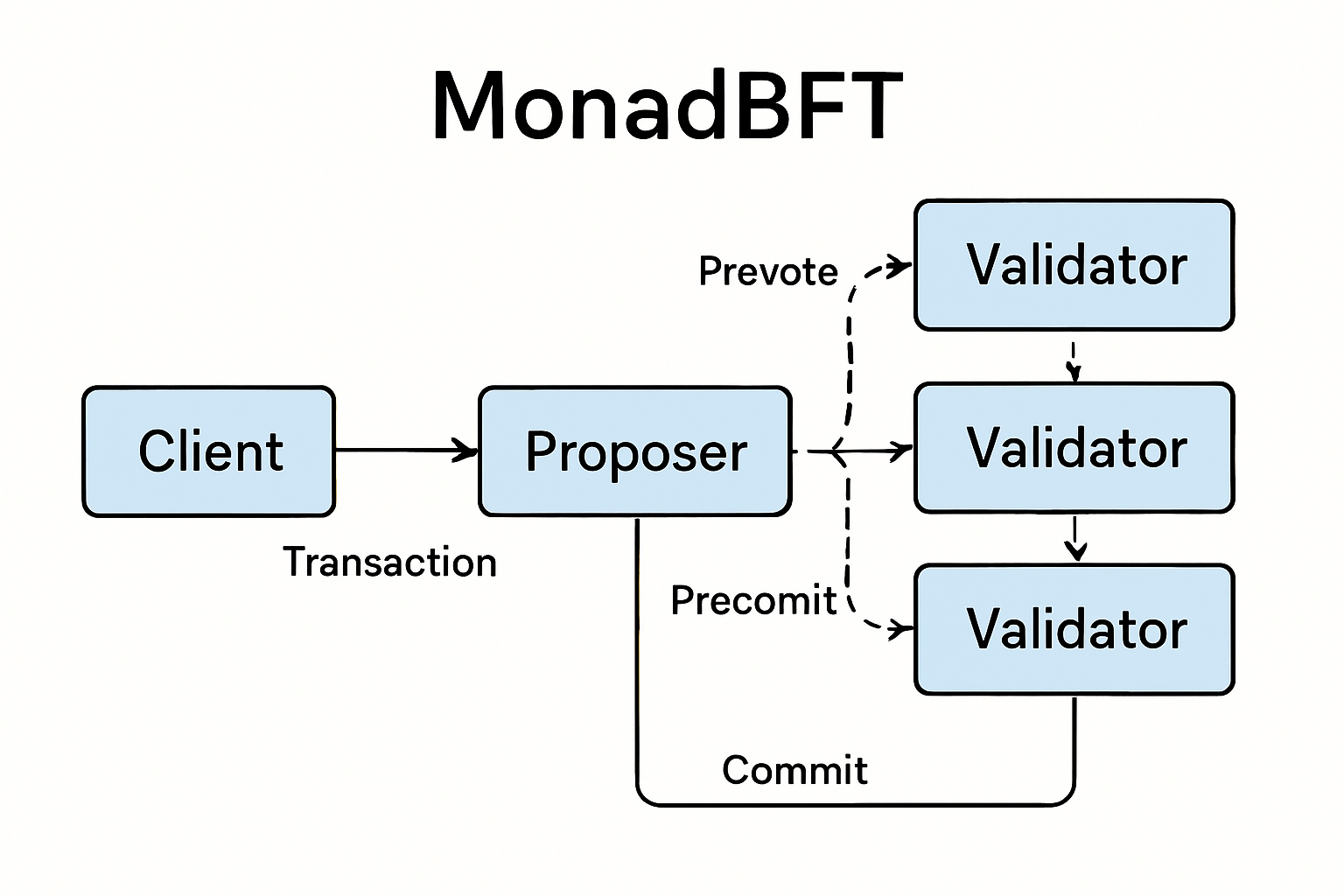

This is paired with a deferred execution model. First, Monad uses its custom MonadBFT consensus (an optimized HotStuff variant) to agree on transaction order quickly and securely. Then, leveraging multi-core processors, it assigns independent transaction groups to run in parallel threads. This design ensures both determinism (the same result every time) and efficiency, sidestepping the tradeoffs that have historically plagued EVM scaling attempts.

Key Differences: Monad vs. Traditional EVM Chains for DeFi Developers

-

Parallel Transaction Execution: Monad analyzes transaction dependencies and executes non-conflicting transactions concurrently, unlike traditional EVM chains that process transactions sequentially. This parallelization dramatically increases throughput and reduces congestion.

-

Significantly Higher Throughput: Monad can process up to 10,000 transactions per second (TPS), far surpassing the typical 10–20 TPS of conventional EVM chains like Ethereum. This enables DeFi DApps to scale efficiently and handle surges in user activity.

-

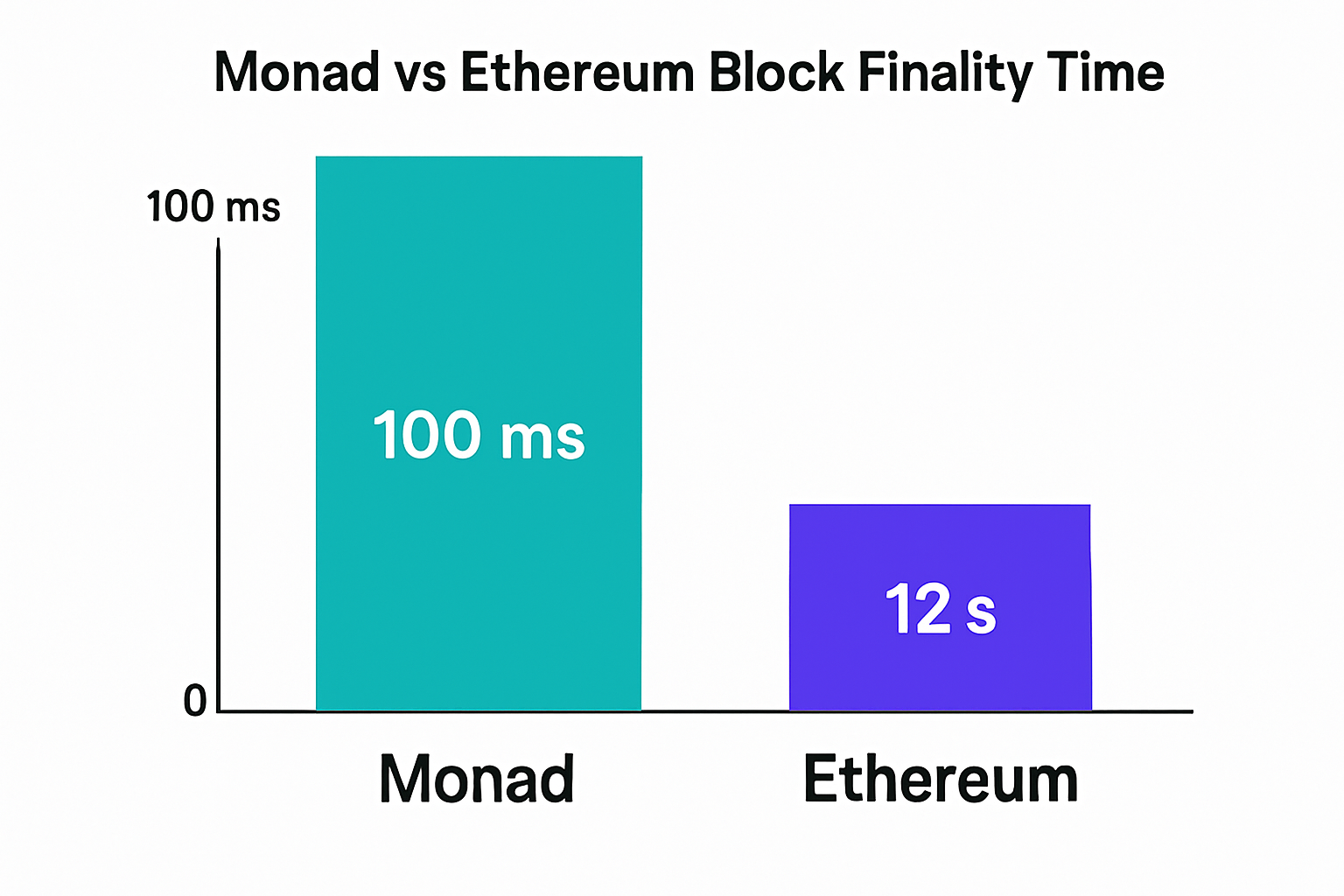

Deferred Execution with MonadBFT Consensus: Monad separates transaction ordering from execution using the MonadBFT consensus mechanism, an optimized version of HotStuff. This approach achieves faster block finality and improves network responsiveness compared to traditional EVM consensus methods.

-

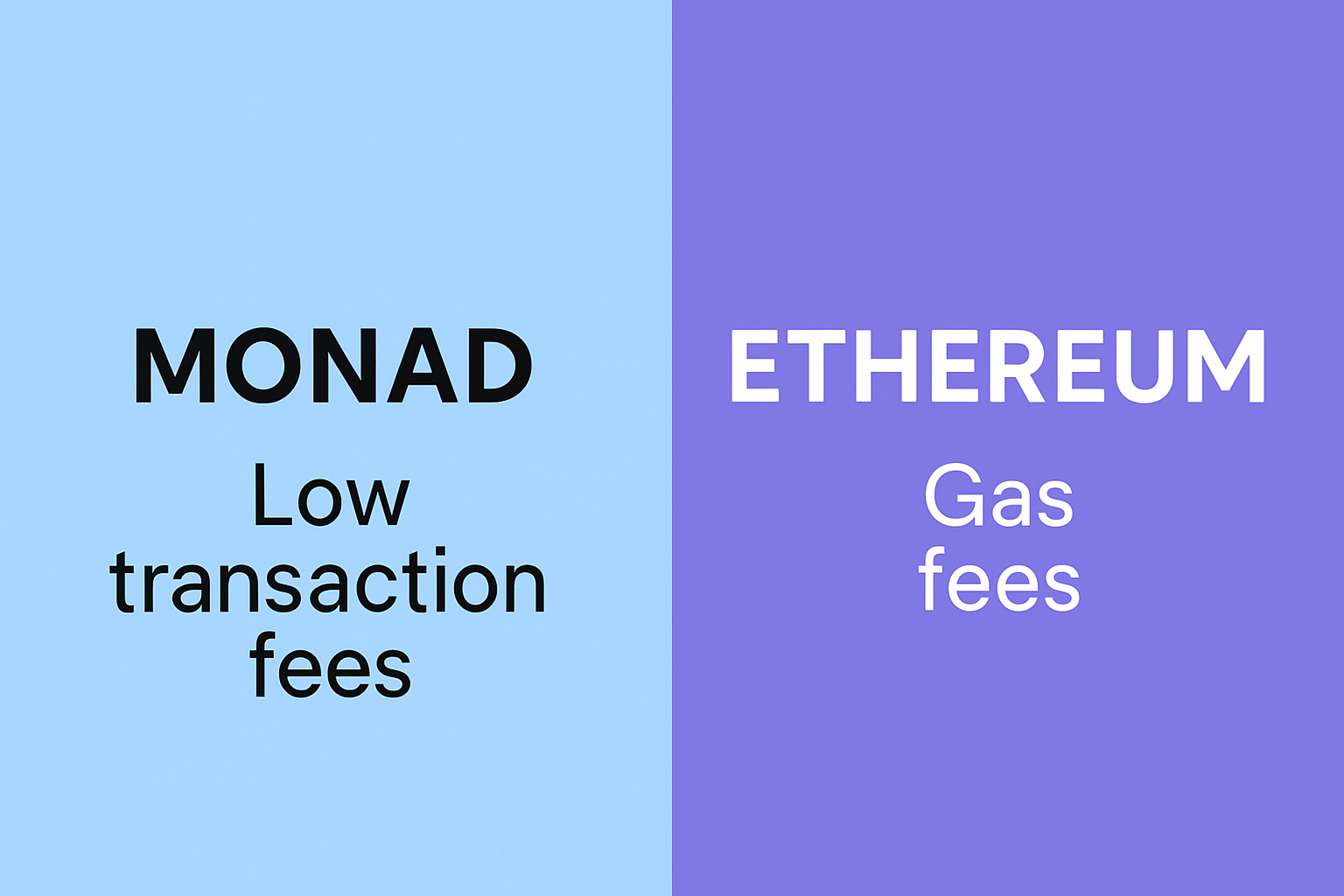

Lower Transaction Fees and Reduced Latency: By increasing processing efficiency and reducing network congestion, Monad enables lower transaction fees and faster confirmation times for DeFi users, making DeFi more accessible and cost-effective.

-

Seamless EVM Compatibility: Monad maintains full EVM compatibility, allowing developers to migrate or deploy existing Ethereum-based smart contracts without significant code changes. This ensures an easy transition for DeFi projects seeking higher performance.

Real-World Impact: DeFi DApps at Web2 Scale

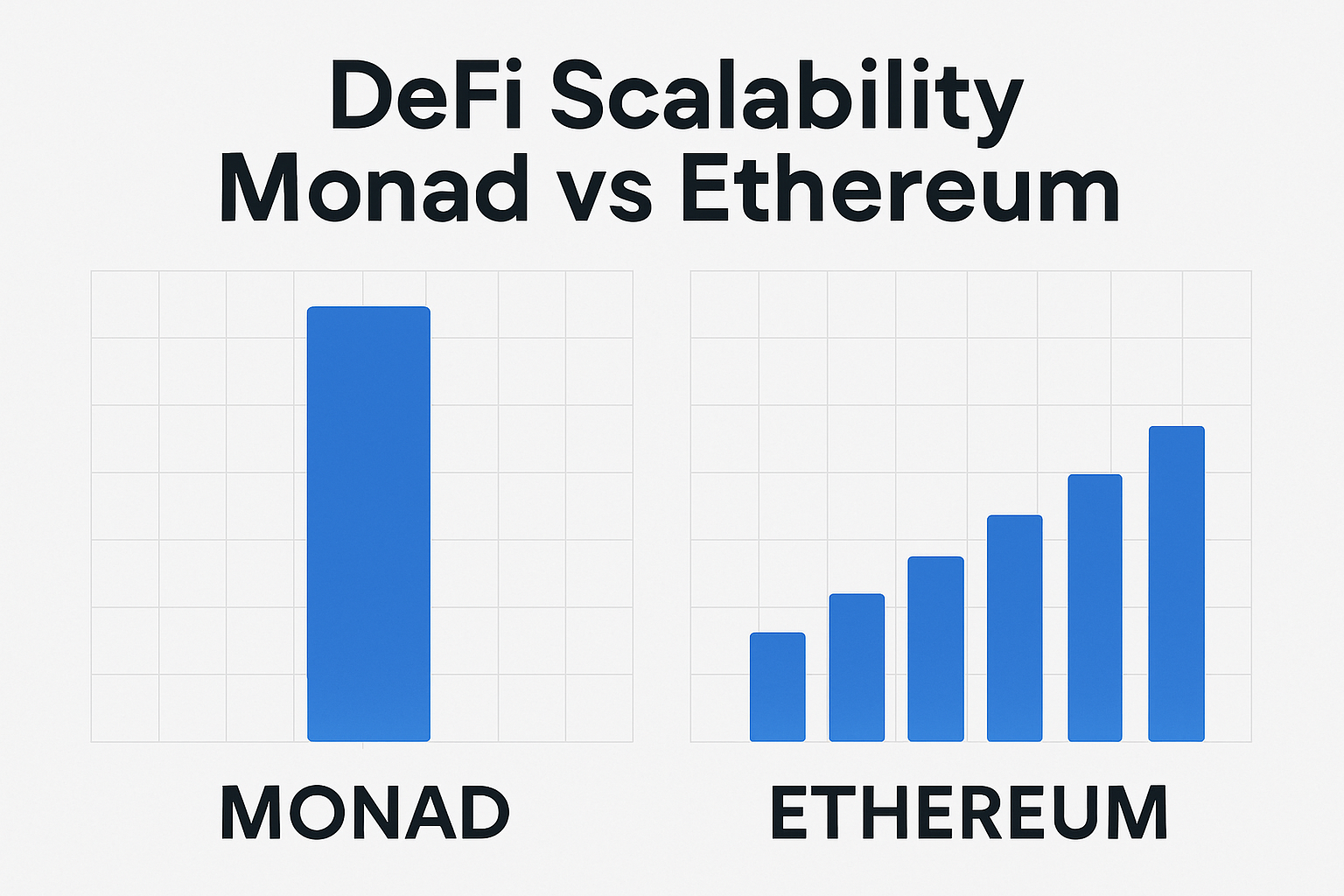

The implications for DeFi are profound. High-throughput execution allows decentralized exchanges (DEXes), lending protocols, and derivatives platforms to process orders and liquidations in real time without gas wars or failed transactions. Lower latency means arbitrageurs can operate more efficiently, while regular users benefit from near-instant confirmations at a fraction of legacy costs.

Crucially, Monad preserves full EVM compatibility. Existing smart contracts can be deployed with minimal changes, allowing developers to tap into this performance leap without rearchitecting their applications. For teams building the next generation of scalable DeFi products, Monad offers an immediately accessible path forward.

As the DeFi landscape becomes increasingly competitive, the ability to deliver seamless user experiences is a key differentiator. Monad’s high-performance EVM chain architecture not only addresses the throughput ceiling but also unlocks new possibilities for protocol design, market structure, and composability. Developers can now architect complex, multi-step transactions and batch operations that would previously be cost-prohibitive or too slow on legacy EVM networks.

For example, decentralized options vaults and automated market makers can settle trades and rebalance portfolios in parallel, reducing slippage and front-running risk. Lending protocols can process hundreds of liquidations simultaneously during volatile markets, maintaining system solvency without backlogs. The net effect is a more resilient, efficient, and accessible DeFi ecosystem that can handle institutional-scale flows alongside retail activity.

Performance Benchmarks: Monad vs. Ethereum

Performance data highlights Monad’s transformative impact. While Ethereum is limited to roughly 10-15 transactions per second (TPS), Monad consistently achieves up to 10,000 TPS in live environments. This leap is not theoretical: it is the result of rigorous engineering and a commitment to maintaining full EVM compatibility, as opposed to introducing shortcuts or proprietary virtual machines.

Monad vs. Ethereum: Throughput and Performance Metrics

-

Transaction Throughput: Monad achieves up to 10,000 transactions per second (TPS), far surpassing Ethereum’s average of 10 TPS. This massive increase is due to Monad’s parallel execution engine, which processes multiple non-conflicting transactions simultaneously.

-

Block Finality: Monad delivers 0.8–1 second finality per block, compared to Ethereum’s 12–15 seconds. Faster finality means DeFi DApps can confirm trades and settlements almost instantly, improving user experience.

-

DeFi Scalability: Monad’s parallel EVM enables DeFi protocols to handle higher transaction volumes without congestion. In contrast, Ethereum’s sequential execution often leads to network bottlenecks and higher fees during peak usage.

-

Transaction Fees: With increased throughput and efficiency, Monad significantly reduces transaction fees for DeFi users, making micro-transactions and high-frequency trading more viable. Ethereum’s limited throughput often results in higher gas costs, especially during periods of high demand.

-

EVM Compatibility and Migration: Monad maintains full EVM compatibility, allowing existing Ethereum DeFi DApps to migrate with minimal changes while benefiting from Monad’s performance gains. This ensures seamless adoption for developers and users alike.

This performance advantage is especially relevant for high-frequency trading, on-chain order books, and NFT marketplaces, where user experience is directly tied to latency and settlement speed. Monad’s architecture ensures that transaction finality occurs in under one second, rivaling the responsiveness of traditional finance platforms while preserving decentralization and security.

Developer Experience and Ecosystem Growth

Monad’s approach dramatically lowers the barrier for existing Ethereum projects to scale. Developers can port Solidity smart contracts, utilize familiar tooling, and integrate with established wallets. This frictionless migration path accelerates adoption and fosters a vibrant ecosystem of interoperable DeFi protocols.

The network’s robust security model, anchored by the MonadBFT consensus, further instills confidence among institutional users and enterprise partners. As more projects deploy on Monad, network effects compound: liquidity deepens, composability expands, and innovation accelerates. The result is an ecosystem where DeFi applications can finally operate at Web2 scale, with none of the legacy bottlenecks.

Looking Forward: The Future of Scalable DeFi

The shift from sequential to parallel execution represents a paradigm change in blockchain design. As demand for scalable DeFi applications continues to grow, platforms like Monad set a new standard for what’s possible in high-performance EVM environments. The ability to process thousands of transactions per second without sacrificing security or developer experience positions Monad as a foundational layer for the next decade of decentralized finance.

For developers and teams seeking to future-proof their applications against congestion and high fees, Monad offers a compelling alternative. Its blend of technical innovation, EVM compatibility, and production-grade security makes it a natural choice for building the next generation of financial infrastructure.

To explore technical details or begin building on Monad today, review our in-depth resources at /how-monad-s-evm-parallelization-boosts-transaction-throughput-for-defi-developers.