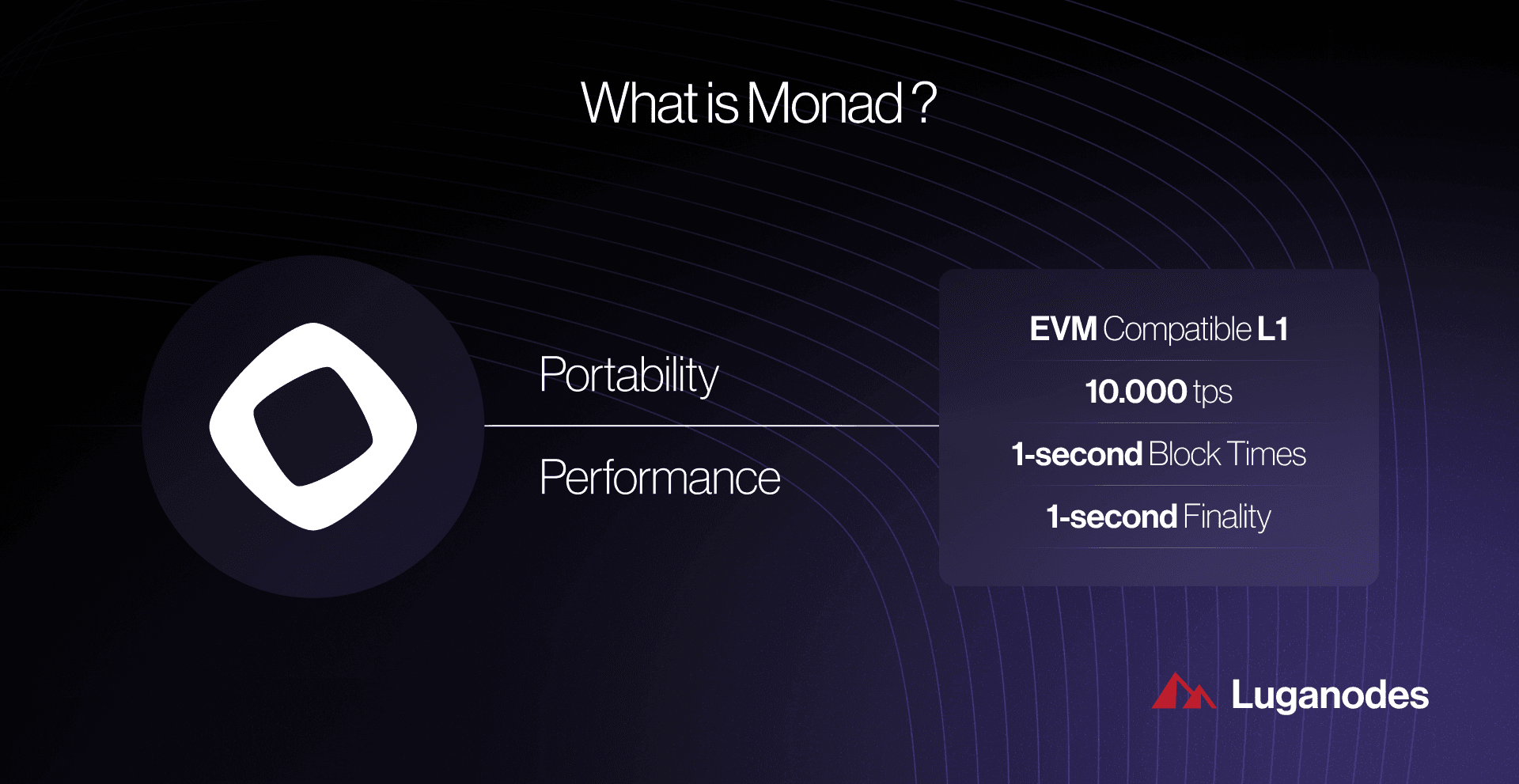

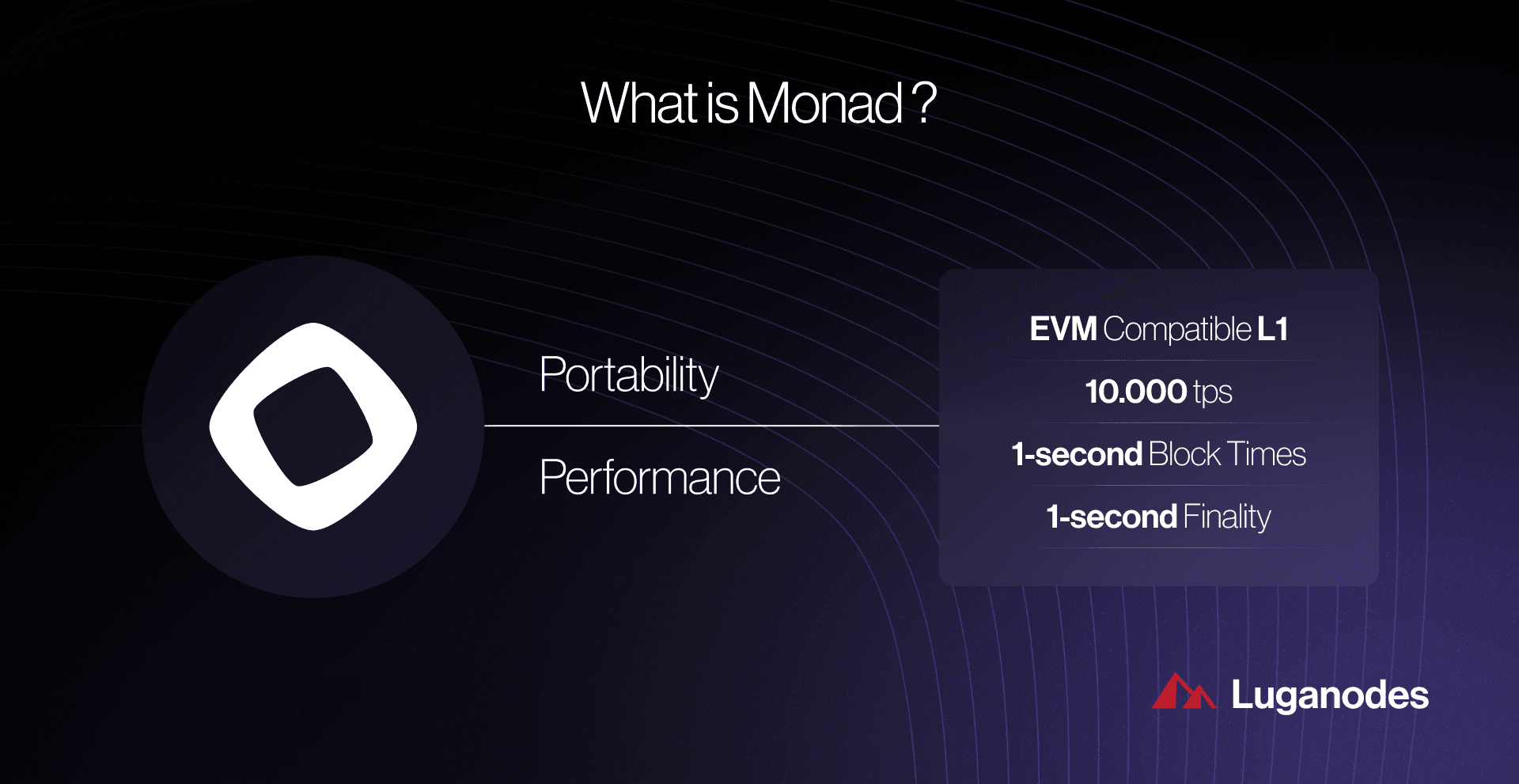

For years, DeFi enthusiasts and blockchain developers have wrestled with a fundamental bottleneck: the Ethereum Virtual Machine (EVM) processes transactions sequentially. This approach, while robust, means that during peak demand, network congestion and high gas fees can cripple user experience. Enter Monad blockchain’s parallel EVM, a game-changer that reimagines how transaction execution can work at scale without sacrificing Ethereum compatibility.

Why Sequential Execution Holds DeFi Back

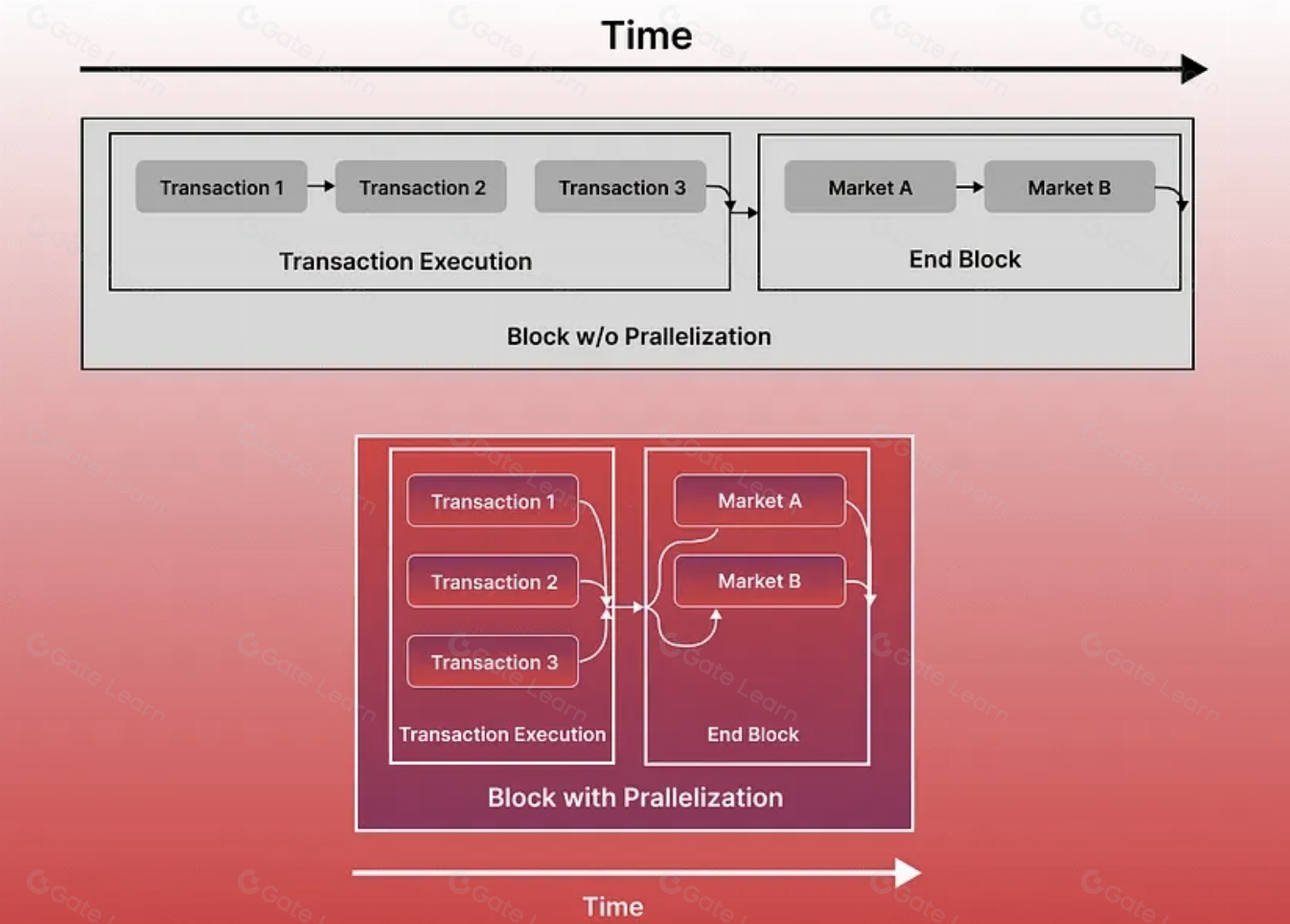

Traditional EVM-compatible blockchains like Ethereum process each transaction one after the other. Think of it as a single-lane road: no matter how many cars (transactions) want to move forward, only one can pass at a time. As DeFi protocols explode in complexity and user base, this model simply can’t keep up. Bottlenecks emerge, dApp users face frustrating delays, and developers struggle to deliver seamless experiences.

The core issue? Sequential execution creates artificial scarcity for blockspace. Even with layer 2 solutions and rollups, the underlying chain’s limitations often peek through during periods of intense activity. This is where Monad’s concurrent transaction execution EVM architecture makes a radical difference.

Monad’s Parallel Execution: The Architecture That Changes Everything

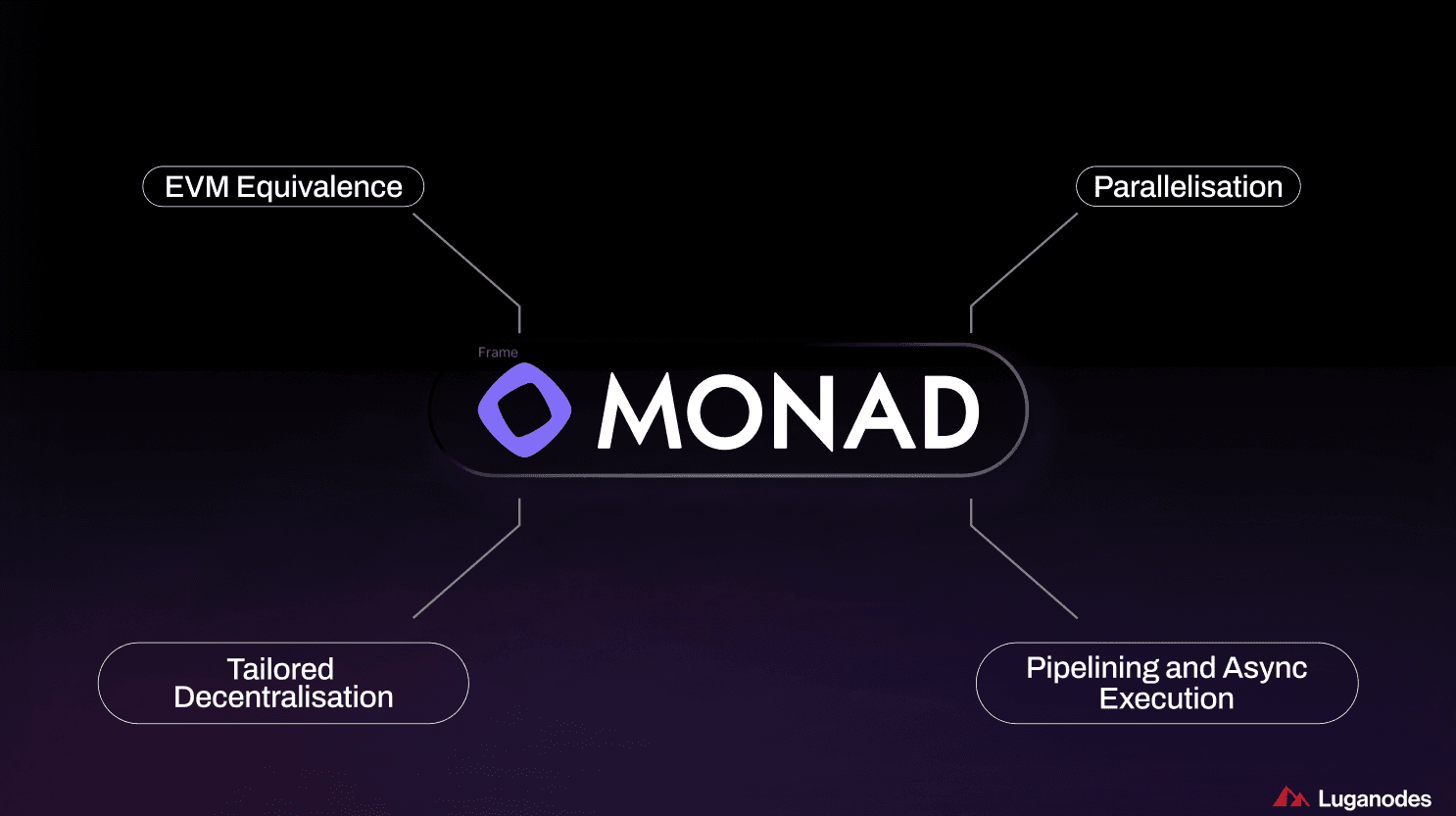

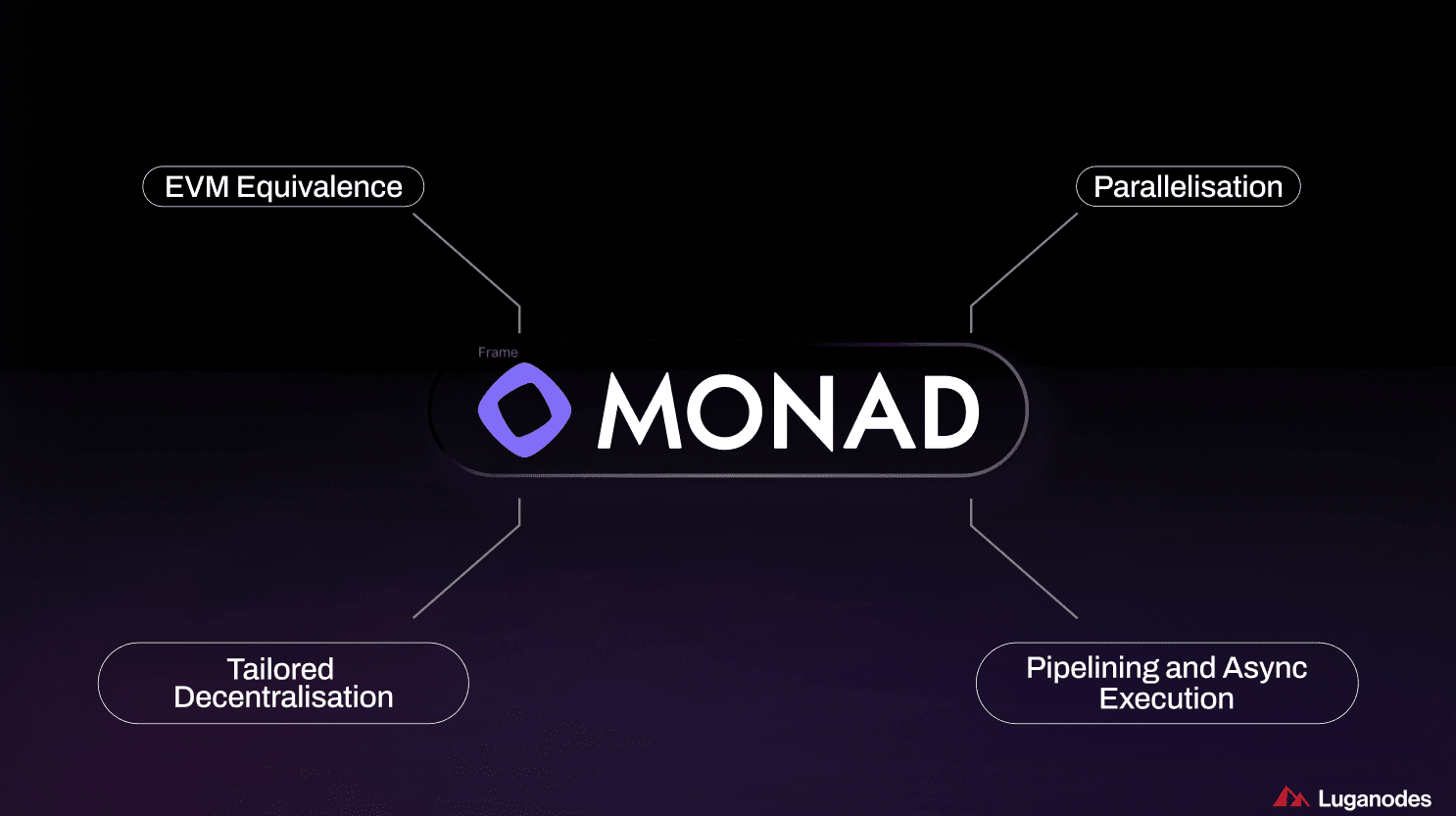

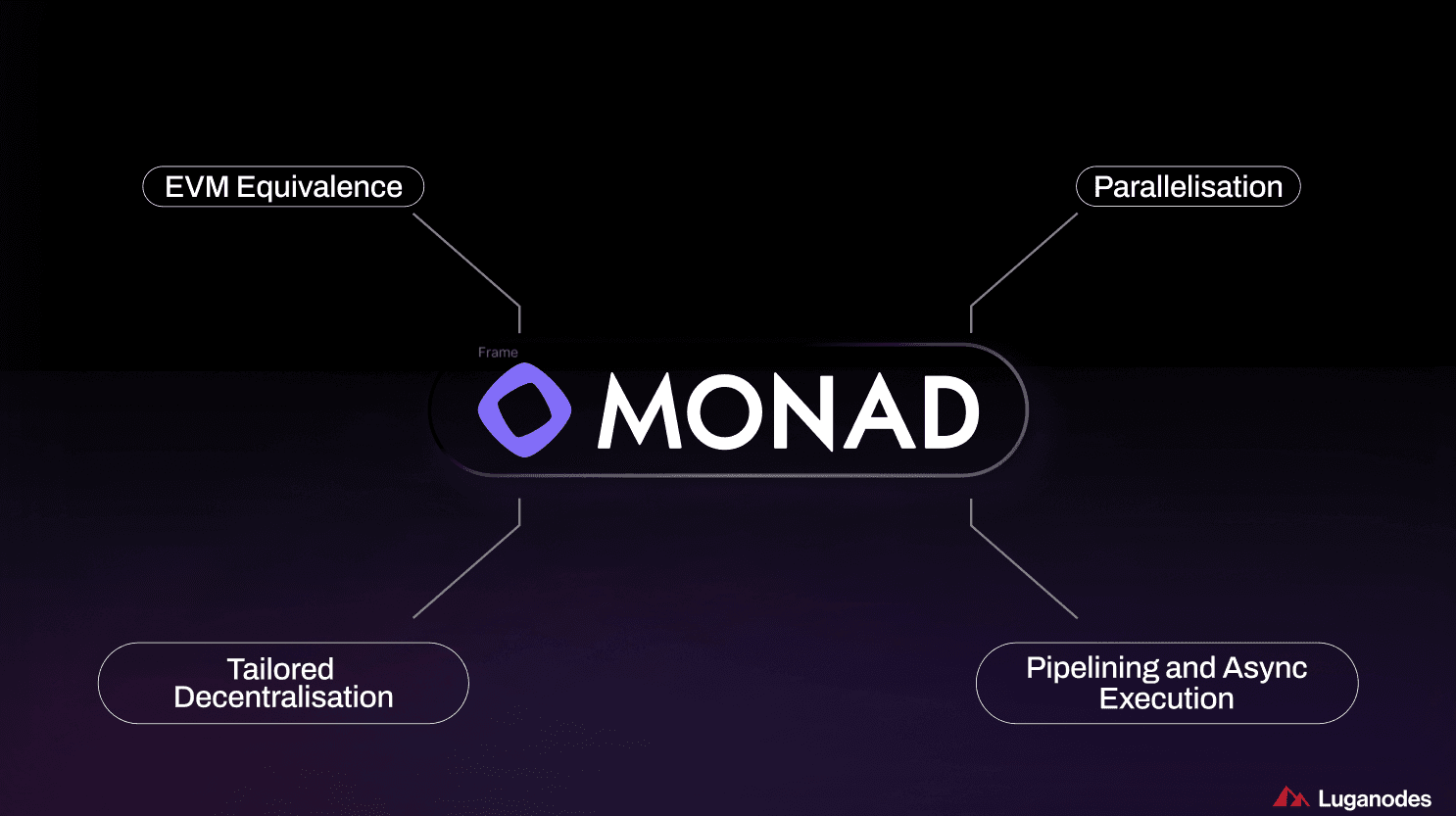

Monad introduces EVM parallelization architecture, allowing multiple transactions to be processed simultaneously, like opening up dozens of lanes on that traffic-clogged road. Under the hood, Monad employs an optimistic parallelization algorithm: it assumes most transactions are independent and can be safely executed in parallel. If two or more transactions do depend on each other, say, one needs data modified by another, Monad detects this and re-executes only the affected transactions in sequence to maintain data integrity.

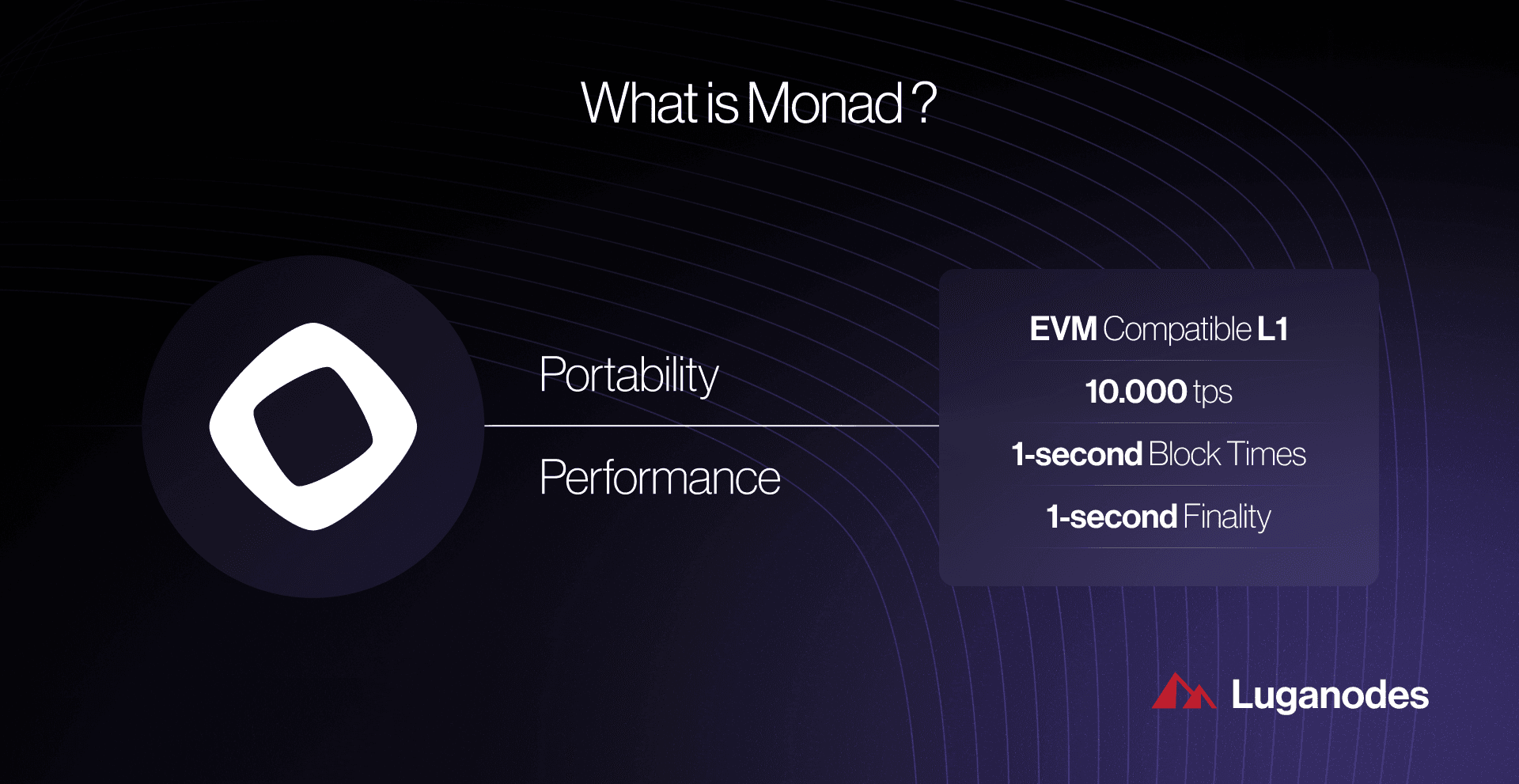

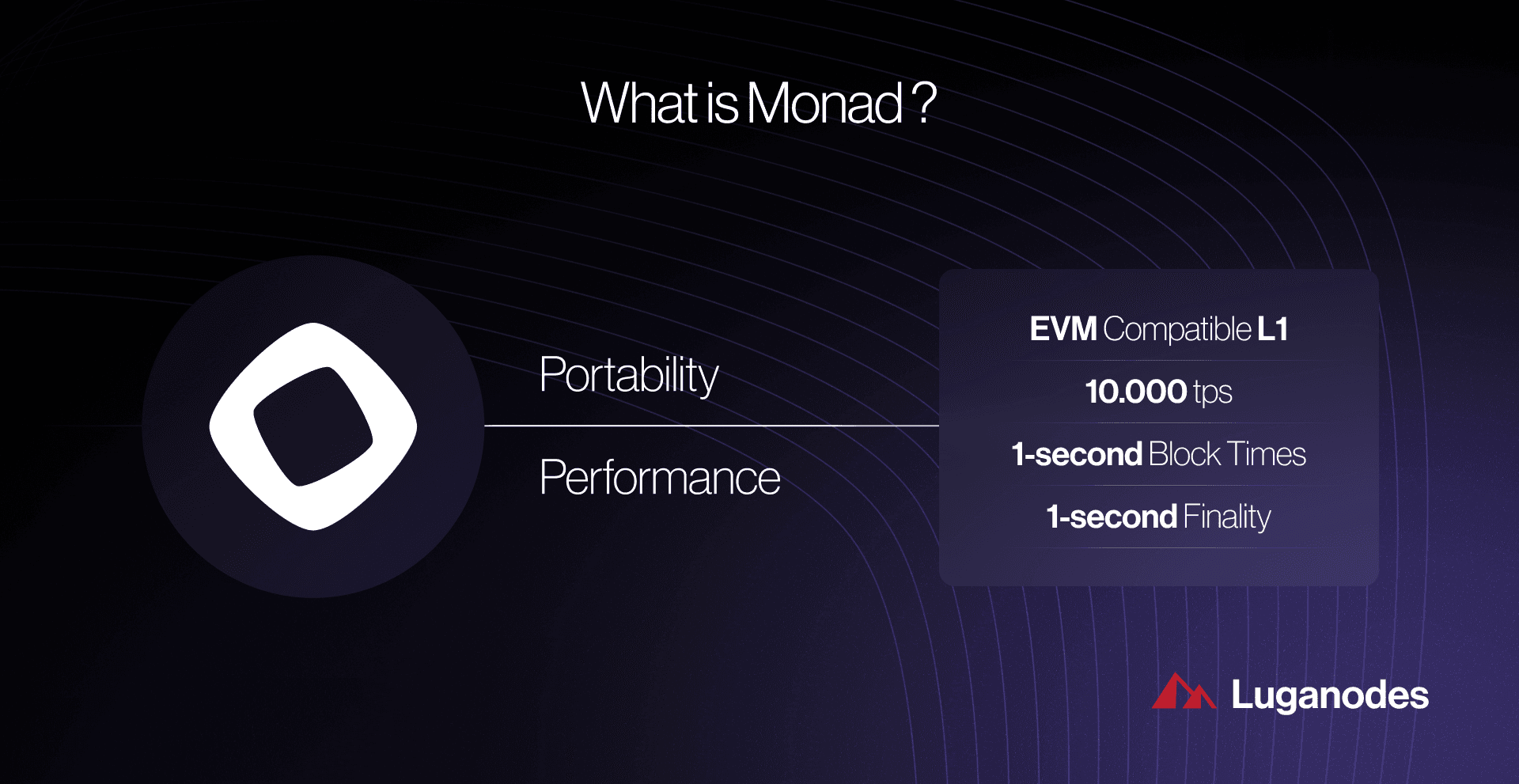

This innovative approach enables Monad to achieve up to 10,000 transactions per second (TPS), dwarfing what’s possible on legacy EVM chains. Finality is reached in a single slot thanks to MonadBFT, an optimized consensus mechanism derived from HotStuff that slashes communication overhead between nodes.

Key Benefits of Monad’s Parallel EVM for DeFi Developers

-

Massive Scalability: Up to 10,000 TPS — Monad’s parallel execution engine allows DeFi apps to handle up to 10,000 transactions per second, eliminating congestion and supporting high-demand use cases.

-

Faster Transaction Finality — With single-slot finality and reduced latency, users experience near-instant transaction confirmations, improving UX for trading, lending, and other DeFi operations.

-

Full EVM Compatibility — Monad supports existing Ethereum smart contracts and tooling, so DeFi developers can easily migrate or deploy dApps without rewriting code.

-

Optimistic Parallel Execution — Monad’s execution model assumes transactions can be processed independently, only re-executing when dependencies are detected, which maximizes throughput while ensuring data integrity.

-

Separation of Consensus and Execution — By decoupling transaction ordering (consensus) from execution, Monad enables higher throughput and efficiency, letting nodes agree on transaction order before processing, which is ideal for high-volume DeFi protocols.

-

Low Hardware Requirements — Unlike some high-performance chains, Monad achieves these gains with modest hardware needs, making it accessible for a wider range of validators and developers.

How Monad Maintains Ethereum Compatibility While Scaling Up

A common concern with new high-performance Layer 1s is whether they break compatibility with existing Ethereum tooling or dApps. Monad sidesteps this pitfall elegantly. Blocks are still structured as linearly ordered sets of transactions, preserving the deterministic outcomes expected by smart contracts built for Ethereum.

The trick lies in separating consensus from execution: nodes first agree on transaction order via consensus (using MonadBFT), then execute them in parallel afterward. This deferred execution model means higher throughput without compromising security or decentralization, a balance few chains have managed to strike so far.

What Does This Mean for Real-World DeFi?

The implications are massive: Uniswap-style AMMs won’t grind to a halt during NFT drops or market volatility spikes; lending protocols can handle liquidations and repayments at scale; new classes of dApps become viable as throughput constraints evaporate.

If you’re curious about how this works under the hood, and what it unlocks for dApp builders, check out our deep dive on how Monad’s EVM parallelization boosts transaction throughput for DeFi developers.

For DeFi projects, the benefits of Monad’s parallel EVM architecture are both immediate and far-reaching. Developers can now launch high-frequency trading protocols, on-chain order books, and real-time gaming dApps that simply weren’t feasible on legacy EVM chains. The days of users waiting minutes for a swap or facing failed transactions due to gas spikes could soon be behind us.

By separating consensus from execution and leveraging optimistic parallelization, Monad achieves a rare trifecta: Ethereum compatibility, ultra-high throughput, and low-latency finality. This is the foundation for a new era of scalable DeFi infrastructure.

Monad vs Ethereum: Performance in Practice

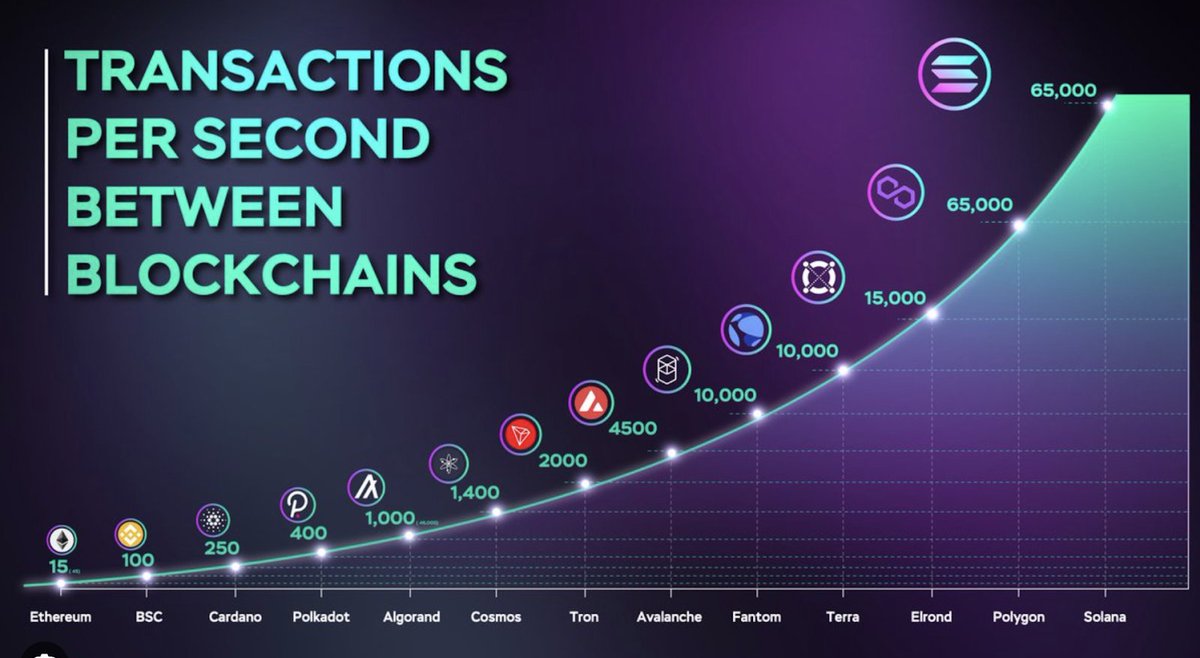

Let’s put numbers to the narrative. Ethereum currently averages around 15-20 TPS under optimal conditions. Monad, by contrast, targets 10,000 TPS, with sub-second block times and single-slot finality. That’s not just incremental progress – it’s a paradigm shift for anyone building or using decentralized finance.

Monad vs. Ethereum: Parallel EVM Performance Showdown

-

Transaction Throughput: Monad achieves up to 10,000 TPS (transactions per second) thanks to parallel execution, while Ethereum processes transactions sequentially, typically handling 15–30 TPS on its mainnet.

-

Execution Model: Monad uses an optimistic parallel execution model, processing multiple transactions simultaneously and re-executing only when dependencies are detected. Ethereum executes transactions one after another, creating potential bottlenecks during high demand.

-

Consensus and Finality: Monad separates transaction execution from consensus using MonadBFT (an optimized HotStuff derivative), enabling faster block finalization and higher throughput. Ethereum combines execution and consensus, which can slow down block confirmation times.

-

DeFi Scalability: Monad offers a robust platform for high-demand DeFi applications, supporting massive user activity without congestion. Ethereum often experiences network congestion and high gas fees during peak periods due to its sequential processing.

-

Developer Compatibility: Monad maintains full EVM compatibility, allowing Ethereum dApps to migrate seamlessly and benefit from higher performance. Ethereum remains the standard for EVM, but lacks Monad’s parallel execution advantages.

What’s more, Monad achieves this without requiring supercomputers or specialized hardware. Its optimizations lower the barrier for node participation, keeping the network decentralized and accessible while scaling up transaction capacity by orders of magnitude.

Security and User Experience at Scale

Security is paramount in DeFi – speed means nothing if users’ funds aren’t safe. Monad’s deferred execution ensures that even with massive throughput, transaction outcomes remain deterministic and auditable. The network automatically detects dependency conflicts during parallel execution and handles them gracefully. This provides developers with predictable results while end-users enjoy near-instant confirmations at consistently low fees.

The result? Protocols can scale without rewriting their smart contracts or sacrificing composability. Any Solidity-based dApp can deploy on Monad and immediately tap into its performance advantages. For builders looking to future-proof their projects against congestion and high fees, this is a compelling proposition.

Unlocking New Possibilities for DeFi Builders

The move to concurrent transaction execution isn’t just about doing more of the same faster – it unlocks entirely new categories of applications:

- High-frequency trading platforms with on-chain order matching

- Real-time NFT marketplaces supporting thousands of mints per second

- Decentralized games with complex state changes processed instantly

- Lending/borrowing protocols handling liquidations at market speed without bottlenecks

- Sophisticated DAOs managing treasury operations in real time

If you want to see how these performance gains translate into practical advantages for developers, our breakdown on how Monad’s EVM parallelization powers ultra-fast dApp performance is worth a read.

Which DeFi use case would benefit most from Monad’s parallel EVM execution?

Monad’s parallel transaction execution enables high throughput and low latency, aiming to solve DeFi scalability bottlenecks. As a developer, which DeFi sector do you think will see the biggest impact from Monad’s performance boost?

The Road Ahead: What to Watch For

The next frontier will be adoption: as more teams migrate their projects or build natively on Monad, we’ll see whether its theoretical throughput translates into real-world network effects. Early benchmarks are promising – but ultimately, it’s user experience that will decide if concurrent transaction execution becomes the new standard for high-performance EVM blockchains.

If you’re interested in the technical nitty-gritty of how Monad keeps Ethereum compatibility while delivering CEX-level speeds, don’t miss our feature on how true parallel execution delivers 10,000 TPS without sacrificing Ethereum compatibility.