Decentralized finance (DeFi) applications have pushed the boundaries of blockchain scalability, but most EVM-compatible chains remain hampered by sequential transaction execution and limited throughput. Monad, a high-performance EVM Layer 1, is engineered to break this bottleneck. By rearchitecting how transactions are processed, leveraging parallelization at the execution layer, Monad unlocks a new level of speed and efficiency for DeFi protocols, making congestion and excessive gas fees relics of the past.

Why Sequential Execution Holds DeFi Back

Traditional EVM blockchains, including Ethereum, process transactions one after another. This model ensures deterministic outcomes but imposes a strict ceiling on throughput: Ethereum averages 10-15 transactions per second (TPS), far below what’s needed for mainstream financial applications. During periods of high demand, think NFT mints or major DeFi launches, the network clogs, confirmation times spike, and fees skyrocket. For developers building sophisticated protocols or serving large user bases, these limitations are non-starters.

This is where Monad’s approach stands apart. Instead of forcing every transaction through the same narrow pipeline, Monad analyzes incoming transactions to identify those that do not interact with overlapping state variables. These non-conflicting transactions can then be executed simultaneously across multiple threads, a leap forward in both theory and practice for EVM throughput benchmarking.

Monad’s Parallelization: The Technical Edge

At the core of Monad’s performance is its parallelized EVM execution layer. The architecture introduces several key innovations:

- Deferred Execution: Monad separates transaction ordering from execution. Validators agree on the order via the robust MonadBFT consensus mechanism before executing transactions in parallel. This decoupling means consensus communication happens swiftly and block finality is achieved in roughly one second.

- MonadDB Storage System: Supporting true parallelism requires a storage engine that can handle multiple simultaneous operations without bottlenecking on disk I/O. MonadDB achieves this with asynchronous read/write processes, ensuring efficient state access even under heavy load.

The impact? Monad routinely targets up to 10,000 TPS with near-instant finality, a generational leap over legacy chains.

The Real-World Benefits for DeFi Developers

For teams building next-generation financial primitives or consumer-facing dApps, DeFi scalability on Monad isn’t just theoretical:

- Massive Transaction Throughput: With up to 10,000 TPS capacity, platforms can scale to millions of users without congestion or failed trades. This is especially critical for high-frequency trading protocols and real-time prediction markets.

- Ultra-Low Latency and Fast Finality: Sub-second block times mean users enjoy nearly instant confirmations, a game-changer for DEXs and lending platforms where speed equals opportunity.

- Dramatically Lower Fees: Efficient resource utilization reduces competition for block space, driving down gas costs across all DeFi activity.

- EVM Compatibility: Developers can port existing Ethereum smart contracts directly onto Monad without rewriting code or abandoning familiar tooling, accelerating time-to-market while benefiting from superior performance.

- Security and Decentralization: Production-grade security via MonadBFT and decentralized validator participation ensure trustless operation at scale.

This combination positions Monad as a foundational infrastructure layer for DeFi’s next phase, one where speed and accessibility are no longer tradeoffs against decentralization or composability. For more technical details on how this works under the hood, see our deep dive: How Monad’s EVM Parallelization Achieves Unmatched Transaction Throughput for DeFi Applications.

Ecosystem Implications: Unlocking New Possibilities

The implications ripple far beyond raw numbers. With parallel processing blockchain technology, entire classes of DeFi products become viable, from decentralized options markets requiring rapid settlement to algorithmic stablecoins balancing thousands of positions in real time. Builders are no longer constrained by infrastructure limits; instead they’re empowered by an environment purpose-built for scale.

As developers and users experience the tangible benefits of Monad’s EVM parallelization, the DeFi landscape is poised for a fundamental transformation. The combination of high throughput, low fees, and seamless Ethereum compatibility is already attracting a new wave of protocol innovation. For example, automated market makers (AMMs) can now support granular order books and more complex trading logic without sacrificing performance. Liquid staking protocols and yield aggregators benefit from instant settlement and composability at scale, while lending markets can safely onboard more collateral types without risking bottlenecks during liquidations.

It’s not just about speed for its own sake. Monad’s architecture enables:

Top DeFi Use Cases Supercharged by Monad’s Parallel EVM

-

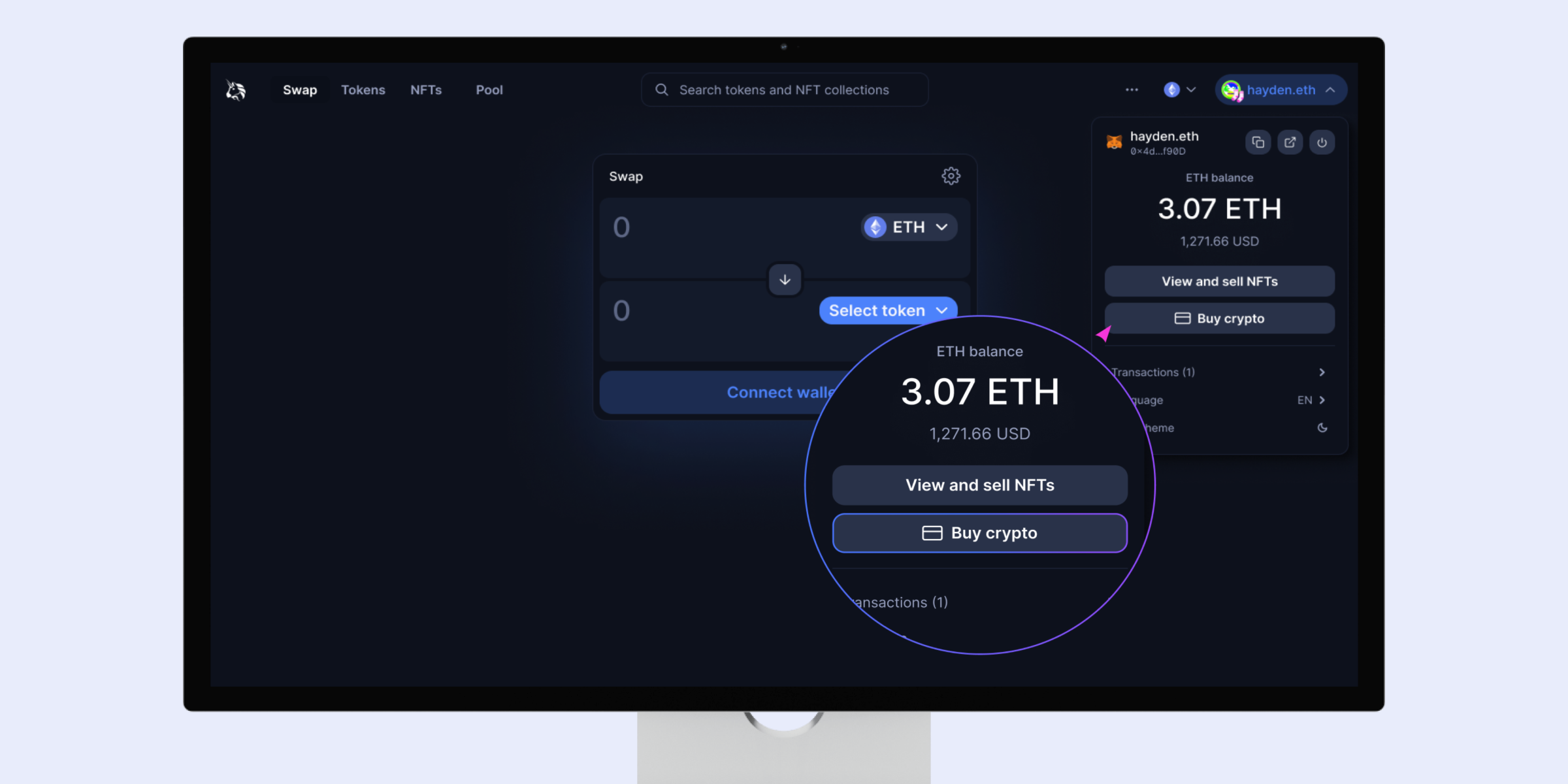

Decentralized Exchanges (DEXs) like Uniswap and SushiSwap: DEXs process massive volumes of swaps, trades, and liquidity provision transactions. Monad’s parallel execution enables high-frequency trading and low-latency swaps, reducing slippage and congestion during peak market activity.

-

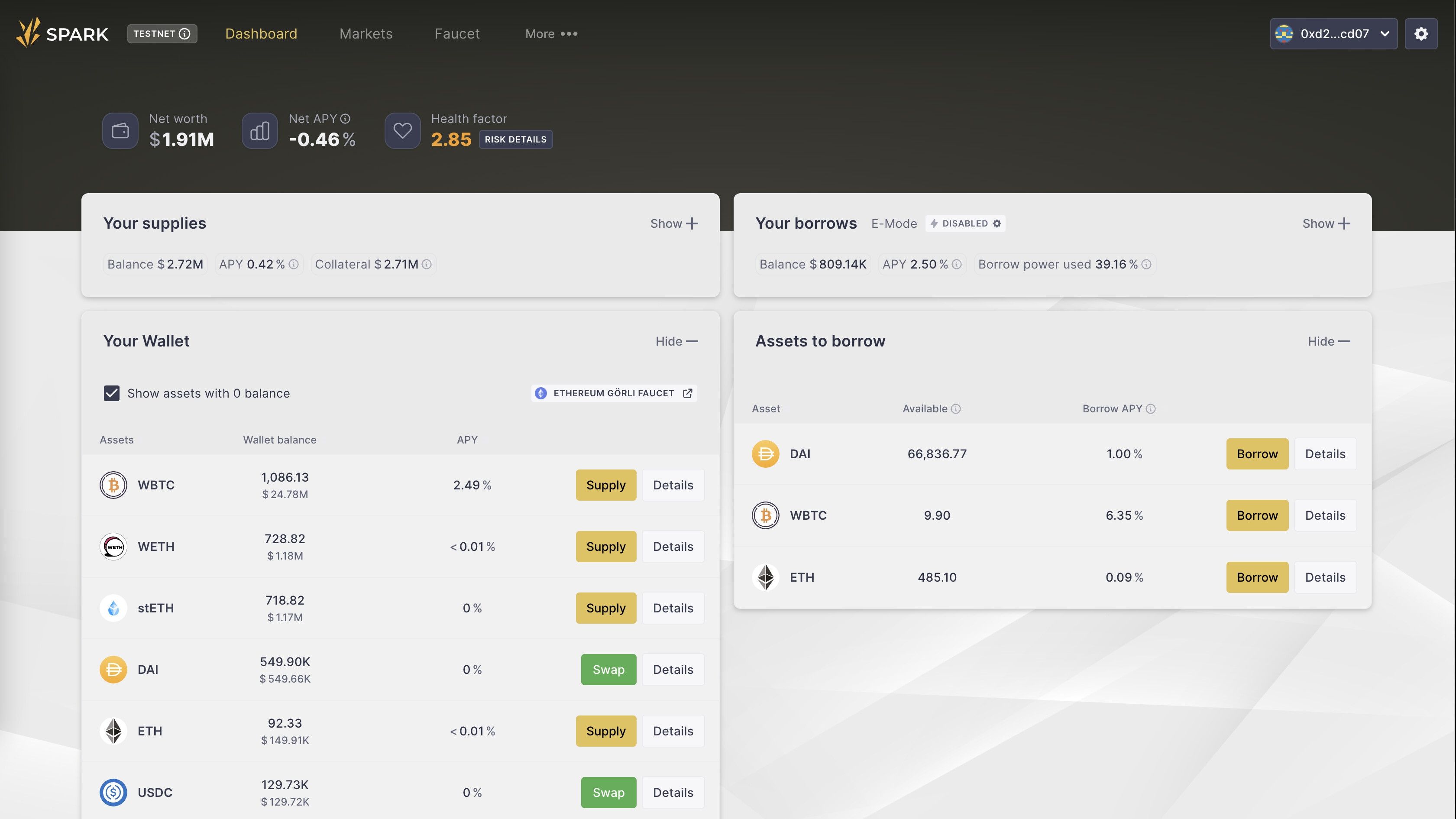

Lending and Borrowing Protocols such as Aave and Compound: These platforms handle a constant flow of deposits, withdrawals, and liquidations. Monad’s throughput allows real-time loan settlements and instant collateral adjustments, greatly improving user experience and protocol resilience.

-

Stablecoin Platforms like MakerDAO and Curve: Stablecoin minting, redemption, and swaps require fast, reliable execution to maintain price stability. Monad’s architecture supports high-volume stablecoin transactions with minimal fees and near-instant confirmation.

-

Yield Aggregators and Automated Market Makers (AMMs) such as Yearn Finance and Balancer: These protocols optimize yield strategies by executing complex, multi-step transactions. Monad’s parallel EVM allows efficient batch processing and dynamic rebalancing at scale.

-

On-chain Derivatives and Synthetic Asset Platforms like dYdX and Synthetix: Derivatives trading and synthetic asset minting demand high-speed order matching and risk management. Monad’s low latency and high throughput enable advanced financial products to operate seamlessly on-chain.

Each of these use cases was previously limited by sequential chains’ inherent congestion or latency issues. Now, with Monad’s deferred execution and parallelized storage engine, builders can confidently architect dApps that would have been impractical or cost-prohibitive on legacy EVM networks.

Performance Benchmarks: Setting New Standards

Early benchmarking results demonstrate the significance of this leap. While Ethereum mainnet typically processes 10-15 TPS under optimal conditions, Monad consistently achieves up to 10,000 TPS, even during periods of network stress. Block finality hovers around one second, orders of magnitude faster than most Layer 1 alternatives. These metrics are not just theoretical; they are being validated in production environments by live DeFi deployments.

This performance isn’t an isolated technical feat, it directly impacts user experience and protocol economics. Lower gas costs mean broader participation, smaller minimum trade sizes, and fewer failed transactions due to slippage or front-running. As a result, DeFi on Monad becomes accessible to both institutional traders requiring reliability at scale and retail users seeking affordable financial services.

Developer Experience: Familiar Tools, Unprecedented Scale

A key aspect driving adoption is Monad’s full EVM compatibility. Existing Solidity contracts can be deployed without modification using familiar frameworks like Hardhat or Foundry. The learning curve is minimal, developers retain access to the vast Ethereum ecosystem while benefiting from drastically improved infrastructure.

For teams evaluating their next deployment target or considering cross-chain expansion strategies, Monad offers a compelling blend of speed, scalability, and security with no compromise on decentralization or code portability.

The Road Ahead for High-Performance EVM Chains

The move toward parallel processing blockchain solutions like Monad signals a maturing industry ready to serve mainstream financial needs. As more projects leverage these capabilities, and as users come to expect instant settlement and negligible fees, the pressure will mount on older chains to evolve or risk obsolescence.

For developers building tomorrow’s DeFi primitives today, choosing an infrastructure that won’t constrain growth is paramount. With its research-driven approach and technical rigor, Monad stands out as both a practical solution for current bottlenecks and a platform for future innovation.