In the converging worlds of decentralized finance and artificial intelligence, protocols that bridge high-throughput blockchains with secure AI agent frameworks are poised to redefine DeFAI. Lioncage Protocol on Monad emerges as a frontrunner, delivering a robust stack for AI agents that thrives at 10,000 transactions per second. This isn’t just about speed; it’s about enabling autonomous agents to handle complex financial operations with ironclad security and Ethereum compatibility.

Monad’s mainnet launch in late 2025 marked a pivotal shift for EVM chains. With its optimistic parallel execution, the network processes transactions concurrently while preserving sequential order, achieving sub-second finality and block times around 0.4 seconds. For Monad AI agents, this means real-time decision-making without the bottlenecks of traditional chains. Builders in DeFAI can now deploy agents that execute trades, manage portfolios, or orchestrate multi-step strategies at scales previously unimaginable.

Monad’s Parallel Execution: The Engine for Secure AI Agents

At the heart of Monad 10k TPS AI capabilities lies a redesigned EVM that identifies independent transactions and executes them in parallel. Unlike sequential processing on Ethereum, Monad’s approach slashes latency and boosts throughput to over 10,000 TPS. This is crucial for AI agents, which often involve chains of micro-transactions: querying oracles, settling payments, or updating positions.

Consider an AI agent monitoring market conditions for a DeFAI yield optimizer. On slower chains, contention delays execution; on Monad, parallelization ensures smooth operation. Lioncage Protocol leverages this by providing a modular stack: custody modules for asset management, payment rails for seamless transfers, and composability layers for integrating with existing DeFi primitives. Security is paramount; the protocol incorporates zero-knowledge proofs for private computations and Monad’s low fees keep operations economical.

Lioncage Protocol: Tailored Stack for DeFAI Builders

Lioncage Protocol Monad isn’t a monolithic solution but a composable framework designed for secure AI agents blockchain environments. It addresses key pain points highlighted in recent discussions: AI agents require more than models; they need reliable infrastructure to act in the real world. Lioncage delivers with features like FireAttention-inspired inference optimizations adapted for on-chain verification, supporting multimodal workloads while prioritizing enterprise-grade privacy.

For DeFAI builders, Lioncage offers plug-and-play components. Custody solutions ensure agents control assets without centralized intermediaries, while payment rails enable autonomous micropayments. The stack’s EVM compatibility means developers can port Ethereum smart contracts effortlessly, accelerating time-to-market. Early integrations show agents handling 10,000 and operations per second, from flash loans to predictive trading, all secured against common exploits like reentrancy.

Scalability Meets Security in the EVM AI Agent Stack

The synergy of Lioncage and Monad redefines what’s possible in EVM AI agent stack development. Traditional concerns around blockchain scalability vanish with Monad’s architecture, which combines parallel execution with optimizations like asynchronous I/O and a custom state database. This results in gas fees fractions of Ethereum’s, making AI-driven DeFi accessible for retail and institutional users alike.

Security protocols in Lioncage go beyond standard audits. Agents employ threshold signatures for multi-party computations and integrate seamlessly with Monad’s finality guarantees. For Monad DeFAI projects, this stack means building agents that not only perform but persist through market volatility. As over 300 projects launched on Monad mainnet day one, Lioncage positions itself as the secure backbone for AI-native finance.

I’ve managed portfolios through multiple crypto winters, and what excites me most about Lioncage Protocol Monad is its pragmatic fusion of performance and prudence. DeFAI isn’t a buzzword; it’s the next evolution where AI agents autonomously navigate yield farms, arbitrage opportunities, and risk-adjusted strategies without human oversight. On Monad’s rails, these agents scale effortlessly, processing thousands of decisions per block.

Real-World DeFAI Use Cases: From Yield Optimizers to Predictive Traders

Picture a Monad AI agents swarm optimizing liquidity across protocols. Lioncage’s stack equips them with oracle feeds for real-time data, parallel execution for simultaneous swaps, and secure enclaves for strategy computation. One builder I spoke with deployed an agent that dynamically reallocates capital between lending pools, capturing yields at rates 20% higher than static strategies, all at sub-cent costs thanks to Monad’s efficiency.

Or consider predictive trading agents in volatile markets. Using multimodal inputs like sentiment analysis from on-chain data and off-chain signals, Lioncage verifies inferences on-chain via lightweight ZK circuits. This secure AI agents blockchain setup prevents front-running and ensures tamper-proof execution. In simulations, these agents handled 10,000 micro-adjustments per second, a feat impossible on legacy EVMs bogged down by congestion.

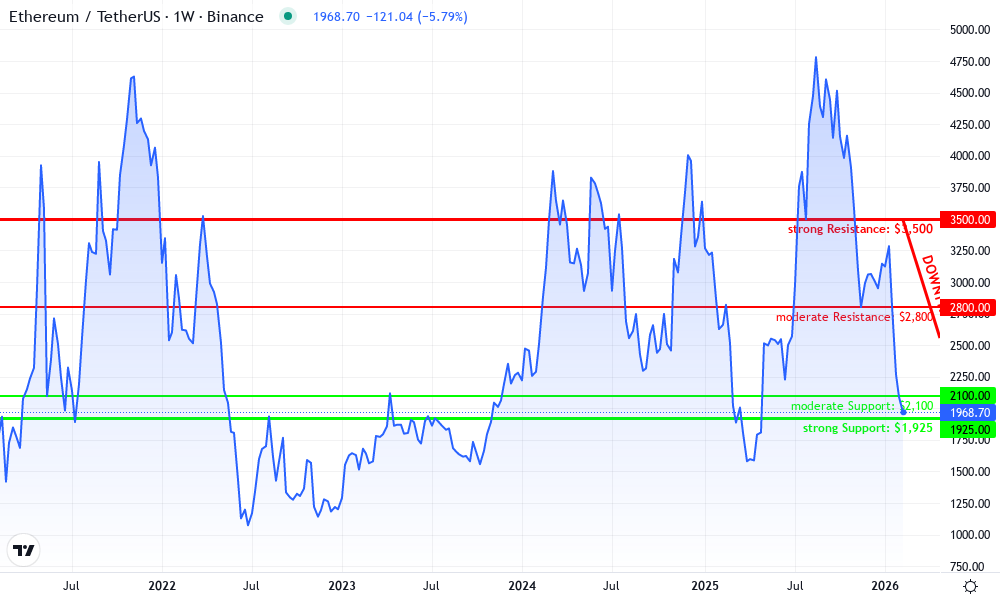

Ethereum Technical Analysis Chart

Analysis by Marina Daley | Symbol: BINANCE:ETHUSDT | Interval: 1W | Drawings: 7

Technical Analysis Summary

As Marina Daley, my conservative technical overlay for this ETHUSDT chart emphasizes key support at the recent lows around $1,925, a potential short-term uptrend from June 2026, and horizontal resistance levels. Use ‘trend_line’ for the downtrend from early 2026 highs and emerging uptrend; ‘horizontal_line’ for support at $1,925 and resistance at $2,800/$3,500; ‘rectangle’ for the recent consolidation range; ‘callout’ on volume spikes for accumulation signals; ‘text’ for labeling levels; ‘long_position’ zone above $2,500 only if confirmed. Avoid aggressive tools like fib_retracement unless multi-year.

Risk Assessment: medium

Analysis: Volatile crypto market with solid support but unconfirmed reversal; aligns with low tolerance by awaiting confirmation

Marina Daley’s Recommendation: Hold diversified portfolio; small position only on confirmed uptrend break, prioritize bonds/stocks for stability

Key Support & Resistance Levels

📈 Support Levels:

-

$1,925 – Strong volume-backed low, prior test in June 2026

strong -

$2,100 – Intermediate support from May 2026 swing

moderate

📉 Resistance Levels:

-

$2,800 – Recent swing high resistance, confluence with prior peaks

moderate -

$3,500 – Q1 2026 high, psychological barrier

strong

Trading Zones (low risk tolerance)

🎯 Entry Zones:

-

$2,550 – Break above short-term trendline with volume confirmation, low-risk long setup

low risk

🚪 Exit Zones:

-

$2,800 – Initial profit target at resistance

💰 profit target -

$1,925 – Protective stop below key support

🛡️ stop loss

Technical Indicators Analysis

📊 Volume Analysis:

Pattern: bullish divergence on lows

Increasing volume on price lows suggests accumulation

📈 MACD Analysis:

Signal: bearish but flattening histogram

MACD line approaching signal, potential bullish crossover if volume supports

Applied TradingView Drawing Utilities

This chart analysis utilizes the following professional drawing tools:

Disclaimer: This technical analysis by Marina Daley is for educational purposes only and should not be considered as financial advice.

Trading involves risk, and you should always do your own research before making investment decisions.

Past performance does not guarantee future results. The analysis reflects the author’s personal methodology and risk tolerance (low).

Builders appreciate the stack’s modularity. Start with basic custody for agent wallets, layer on payment composability for atomic multi-calls, then add governance modules for upgradable logic. EVM bytecodes run verbatim, so Solidity devs migrate in hours, not weeks. This lowers barriers, inviting more talent to craft sophisticated Monad DeFAI primitives.

Overcoming AI Agent Challenges on High-Throughput Chains

Critics might worry about centralization risks or oracle dependencies, but Lioncage mitigates these head-on. Decentralized key management via MPC distributes control, while diverse oracle networks feed verified data. Monad’s 0.8-second finality acts as a trust anchor, settling agent actions before markets shift. From my FRM lens, this risk framework rivals TradFi derivatives clearing, minus the opacity.

The protocol’s HIPAA-inspired privacy layers shield sensitive strategies, appealing to institutions eyeing on-chain alpha. SOC2 compliance in the stack signals maturity, reassuring family offices I’ve advised. Gas optimization further sweetens the deal; at fractions of a penny per tx, agents run perpetually, compounding edges over time.

For portfolio managers like myself, Lioncage unlocks diversified exposure to DeFAI. Agents can mirror benchmarks, hedge via perps, or scout niche opportunities across Monad’s ecosystem. With 10,000 TPS as the baseline, the ceiling feels limitless.

Getting started is straightforward. Deploy via Lioncage’s SDK, test on Monad’s devnet, then go live on mainnet. Community resources abound, from docs to Discord channels buzzing with builder collabs. As Monad’s ecosystem swells past 300 projects, Lioncage carves a niche as the go-to for performant, secure AI orchestration.

In a market craving sustainable innovation, this stack stands out. It doesn’t promise moonshots; it delivers reliable infrastructure for agents that think, act, and scale. Diversify into DeFAI thoughtfully, and let protocols like Lioncage handle the heavy lifting.