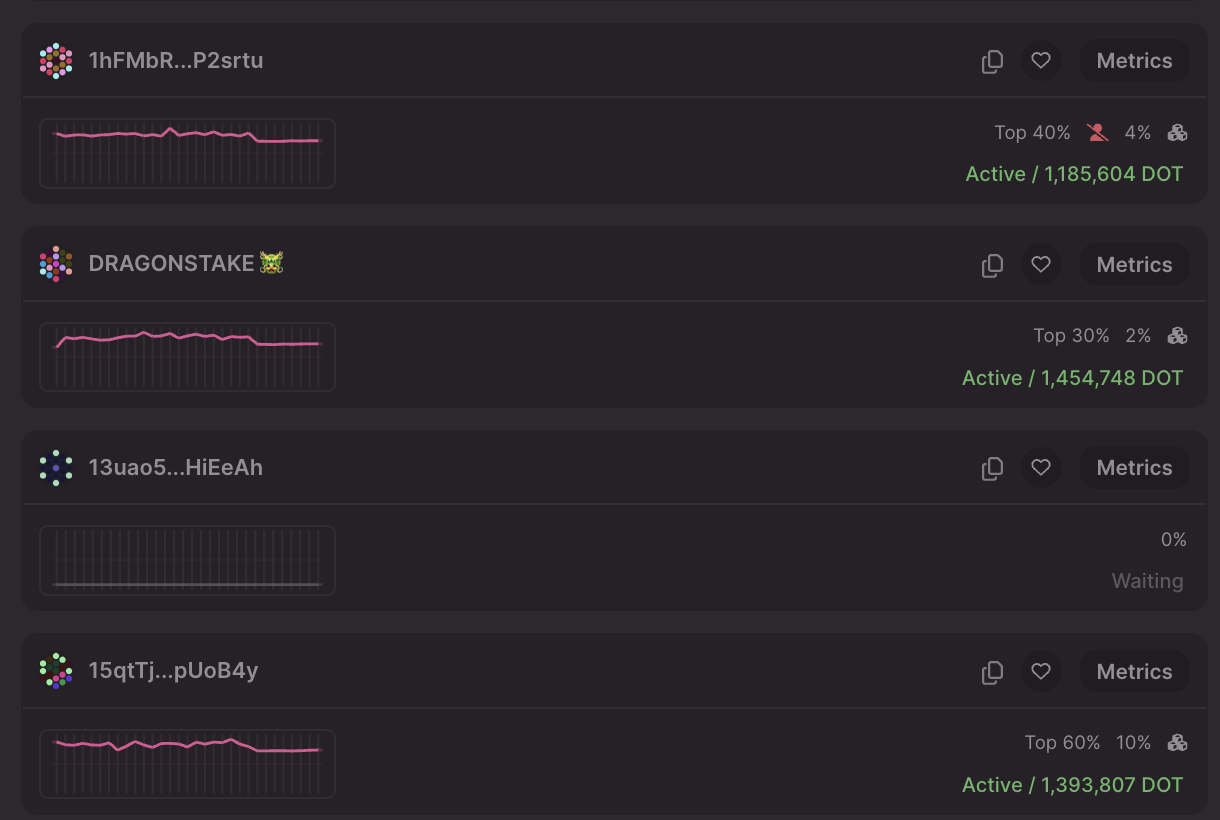

Recent highlights from the Monad testnet underscore a maturing ecosystem where validator performance directly influences network reliability and user confidence. Operators achieving 888 blocks produced and 947 transactions processed, backed by over 10 million in delegated stake, exemplify the precision required in a delegated Proof-of-Stake environment. This isn’t mere numbers; it’s a signal of operational excellence amid Monad’s push for 10,000 TPS, 0.4-second block times, and 0.8-second finality.

These figures from institutional players like Klydexglobal reveal more than raw output. They highlight a validator set that’s not just participating but dominating block production cycles. As Monad’s testnet evolves, with upgrades slashing block times from 500 to 400 milliseconds, such metrics become crucial for delegators weighing monad staking strategies. I’ve long advocated for thorough due diligence in staking, much like traditional asset allocation, and here the data supports selective delegation to proven performers.

Unpacking Monad Testnet Validator Supremacy

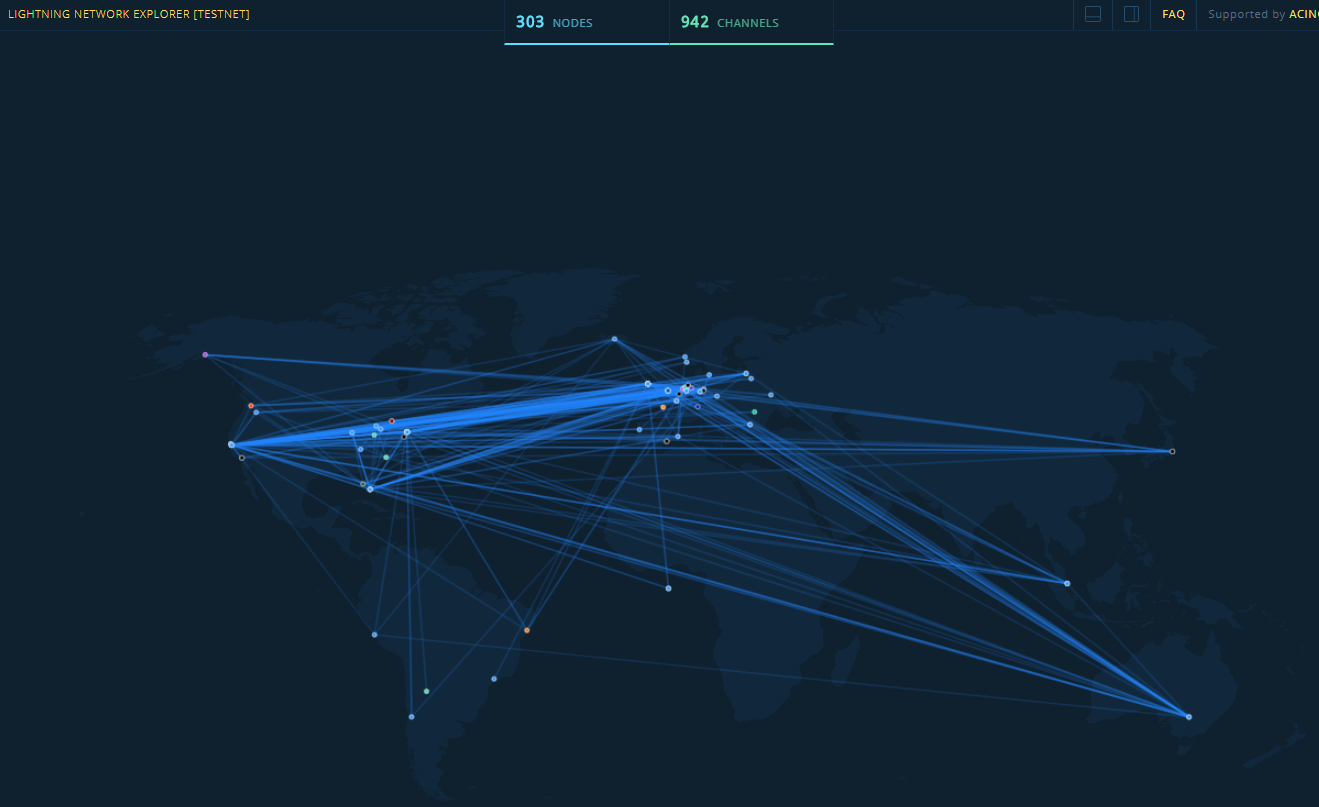

The Monad testnet has processed over 255 million successful transactions at a 98.18% success rate across 90 days, with median fees hovering at 0.0028 MON. Block production rates average 98.75%, peaking at 100% for standout nodes like Twinstake. This stability in consensus efficiency is no accident; it’s engineered through parallel EVM execution and a growing active set of 186 validators spanning Romania to Singapore.

Monad Testnet Key Metrics

| Metric | Value | Details |

|---|---|---|

| Blocks Produced | 888 | Average standout performance |

| Transactions Processed | 947 | Standout; 255M total successful |

| Transaction Success Rate | 98.18% | Over past 90 days |

| Block Time | 0.4s | Enhanced from 0.5s for faster processing |

| Delegated Stake | 10M+ | Strong validator participation |

| Active Validators | 186 | Global distribution including Romania, Germany, etc. |

Consider the implications for monad validator performance. In a dPoS system, proposers earn block rewards and priority fees, shared with delegators after commission. If your stake represents 20% of a validator’s total, you claim a proportional cut. Yet, rotation mechanisms ensure no single entity monopolizes, fostering decentralization while rewarding consistency. From my vantage in fundamental analysis, this balance mirrors sustainable portfolio construction: diversify, but prioritize yield-generating anchors.

Stake Allocation Tactics in a High-Throughput Era

Crafting effective monad staking strategies demands scrutinizing infrastructure alongside historical output. Top validators distinguish themselves via uptime, geographic diversity, and low slash risk. With 310 million unique addresses and 7 transactions per wallet on average, engagement is robust, but delegators must navigate commission rates and reward volatility.

Key Monad Validator Criteria

-

1. Block Production RateAim for 98%+ uptime. Network avg: 98.75%; Twinstake hit 100% in Testnet-2 for reliable consensus.

-

2. Delegated Stake ThresholdTarget 10M+ MON for stability. Klydexglobal exceeds this, ensuring robust participation amid 186 active validators.

-

3. Commission RateSeek under 10% to maximize delegator rewards. Review via staking dashboards for fair reward sharing.

-

4. Multi-Region NodesPrioritize resilience with nodes in Romania, Germany, Ireland, South Korea, Singapore for decentralization.

-

5. Proven Testnet TenureChoose validators with long Testnet-2 history, like those processing 255M+ txns since Feb 2025 launch.

Delegating to performers like those hitting 888 blocks isn’t gambling; it’s informed conviction. Monad’s testnet, now surpassing 2.6 billion transactions and 34 million blocks in prior phases, tests real-world scalability. Validators rotating efficiently prevent centralization, much as market rotations in TradFi preserve liquidity. I see parallels to long-term bond ladders: steady accrual through reliable counterparties.

Benchmarks That Define High-Performance EVM Validators

Zooming into specifics, the 947 transactions milestone per validator session reflects Monad’s hyperscaling prowess. Parallel execution allows simultaneous processing, unlike sequential Ethereum, yielding sub-second finality. For high performance EVM validator aspirants, this means investing in optimized RPC endpoints and hardware capable of 10,000 TPS bursts.

High-performance EVM validators must prioritize redundancy in their setups, from geographically distributed nodes to robust monitoring tools that flag latency spikes before they impact block proposals. Monad’s ecosystem rewards those who treat validation as a disciplined operation, not a side hustle. Operators logging consistent monad testnet blocks produced like the 888 benchmark set a standard that separates leaders from laggards.

Infrastructure Imperatives for Validator Dominance

Delving deeper, Monad’s 0.4-second block times demand hardware that can handle parallel transaction execution without bottlenecks. Think NVMe SSDs for rapid state access, high-core CPUs for EVM parallelism, and ample RAM to cache hot data. RPC infrastructure providers like Triton One underscore this by rolling out optimized endpoints tuned for 10,000 TPS. In practice, validators outperforming at 947 transactions per session leverage such stacks, ensuring they rotate into proposal slots with minimal downtime.

From a strategic lens, I’ve observed that top monad testnet validators maintain uptime above 99.9%, a threshold that aligns with institutional-grade reliability. Geographic spread across Europe, Asia, and beyond mitigates latency risks, much like diversifying equities across sectors buffers against sector-specific downturns. With 186 active validators, the network strikes a decentralization sweet spot, avoiding the pitfalls of over-consolidation seen in some PoS chains.

Delegation Blueprint: Checklist for Savvy Stakers

Delegators stand to gain most by aligning with validators who embody these traits. Monad’s reward sharing mechanism amplifies the upside: priority fees flow directly to stakers post-commission, creating a compelling yield profile in a low-fee environment where medians sit at 0.0028 MON. Yet, success hinges on methodical selection amid rotation dynamics.

This checklist isn’t exhaustive, but it forms the core of sound monad staking strategies. Apply it rigorously, and you’ll mirror the patience I preach in value investing: compound returns through vetted positions rather than chasing fleeting highs. Testnet data, with 255 million successful transactions and 310 million unique addresses, validates the network’s traction. Average wallet activity at seven transactions signals genuine utility, not speculative froth.

Looking ahead, as Monad barrels toward mainnet, these testnet benchmarks will harden into production realities. Validators who’ve nailed 100% proposal rates, like Twinstake, position themselves as foundational players. For enterprises eyeing EVM scalability, delegating here offers exposure to a chain rewriting throughput rules. My take? In a sea of EVM iterations, Monad’s fusion of speed and compatibility carves a defensible moat. Stakers who internalize monad validator performance metrics today will reap tomorrow’s dividends, blending blockchain’s volatility with finance’s timeless principles.

The rotation of validators, backed by over 10 million in stake, ensures no single operator rests on laurels. This meritocracy drives continuous improvement, echoing how competitive markets hone efficiency. With block production averaging 98.75% and fees remaining negligible, Monad testnet isn’t just performing; it’s proving a thesis on hyperscale viability. For long-term allocators, selective delegation here embodies calculated conviction over blind accumulation.