In the high-stakes arena of EVM-compatible blockchains, Monad stands out with its blistering 10,000 TPS and 0.8-second finality, positioning it as a frontrunner for developers pushing decentralized applications to new limits. Yet, beyond raw performance, the real alpha lies in its testnet ecosystem, particularly the Monad Momentum program through Kizzy. This initiative dangles 6698 MON tokens via the Kizzy Mobile Leaderboard, a gamified battleground where early participants can claim disproportionate shares. With MON trading at $0.004032, down a modest 0.0359% in the last 24 hours between a high of $0.004205 and low of $0.004014, strategic engagement here offers leveraged exposure to Monad’s ascent without mainnet risks.

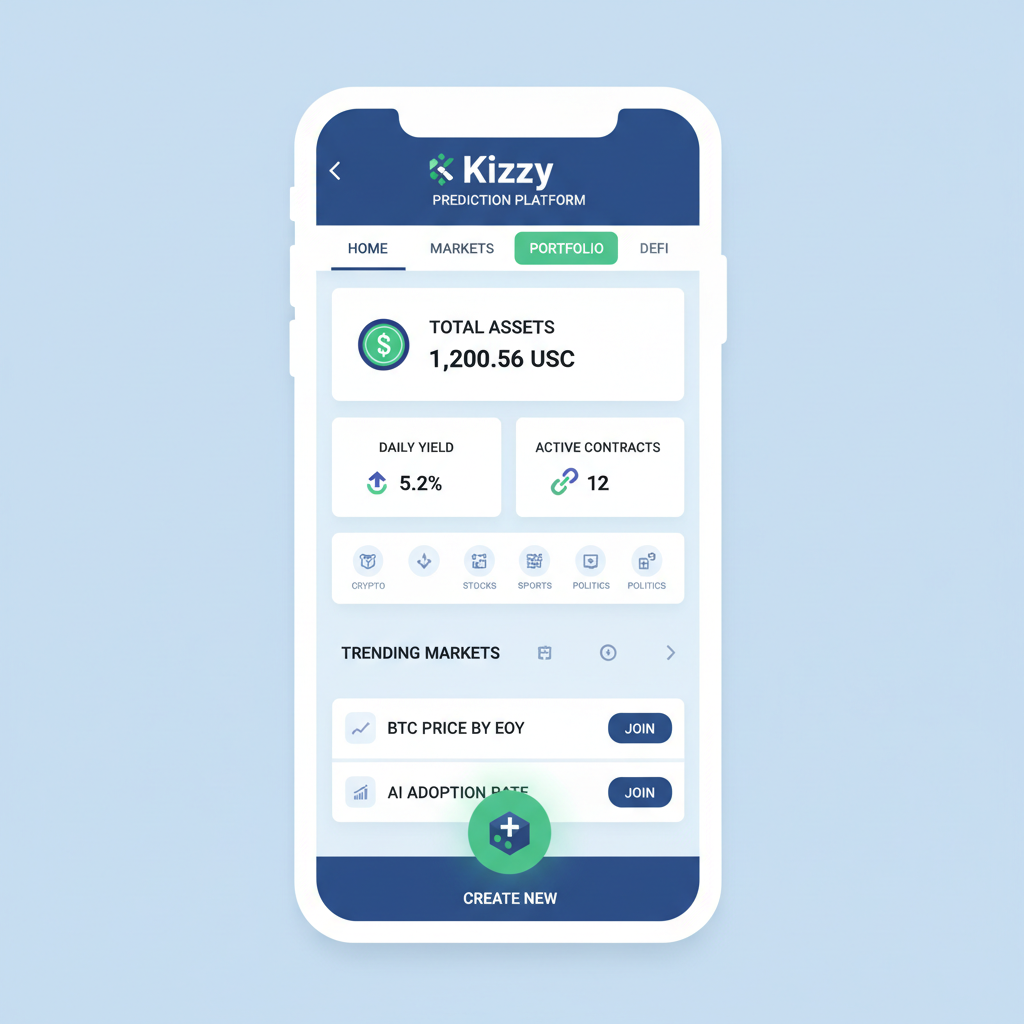

Kizzy transforms social media predictions into a competitive edge on Monad’s testnet. Players accumulate Purple K through real-money games, missions, and referrals, directly fueling leaderboard climbs. Monthly, the reward pool splits proportionally; snag 5% of Purple K, pocket 5% of MON tokens wired to your wallet. This isn’t casual gaming; it’s a calculated farm for Monad testnet rewards, amplifying early Monad ecosystem participation amid a market ripe for high-performance chains.

Decoding the Monad Momentum Mechanics

The Monad Foundation’s Momentum program sharpens focus on sustained activity over one-off spins. Purple K earnings dictate allocations from pools like the 6698 MON leaderboard prize. High-volume predictors on social metrics, views, and followers dominate, but savvy users layer missions and referrals for exponential gains. Seasonal tasks unlock multipliers, turning daily grinds into leaderboard assaults. From a portfolio strategist’s lens, this mirrors compounding in bonds or commodities: consistent inputs yield outsized terminal value. Ignore the noise; position for monthly snapshots where top Purple K holders feast.

Participants earn MON tokens by accumulating ‘Purple K’ through real-money games, completing missions, and referring friends. Rewards distribute proportionally at month-end.

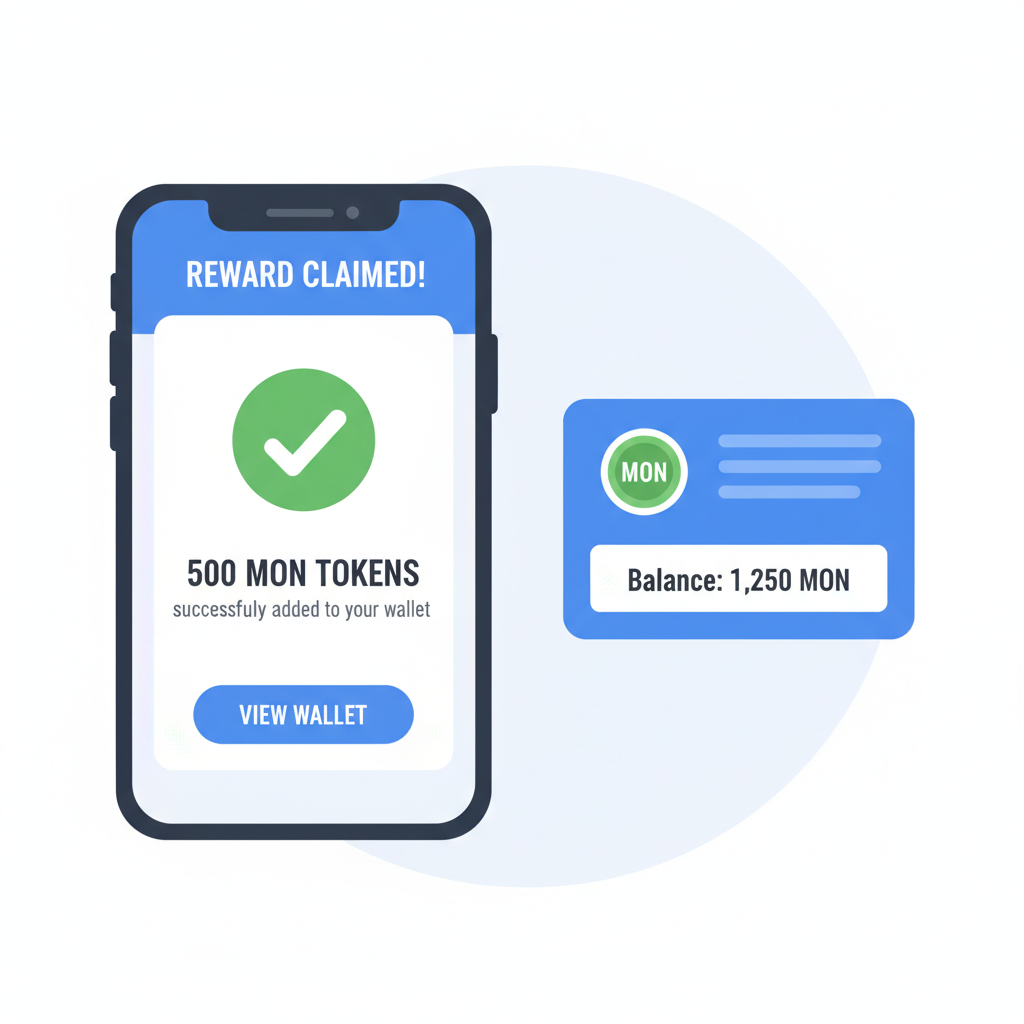

Current dynamics favor aggressors. zkCodex users already tasted distributed leaderboard rewards, netting 10 MON each for streaks. Mitosis University spotlights Kizzy’s prediction markets as prime for MON tokens leaderboard glory. DappRadar and Bitget underscore testnet faucets as entry points, but Kizzy elevates via gamification. Stake testnet MON on Magma for gMON if liquidity staking fits your thesis, yet leaderboard hunting via mobile trumps passive holds for velocity.

Setting Up for Kizzy Mobile Monad Dominance

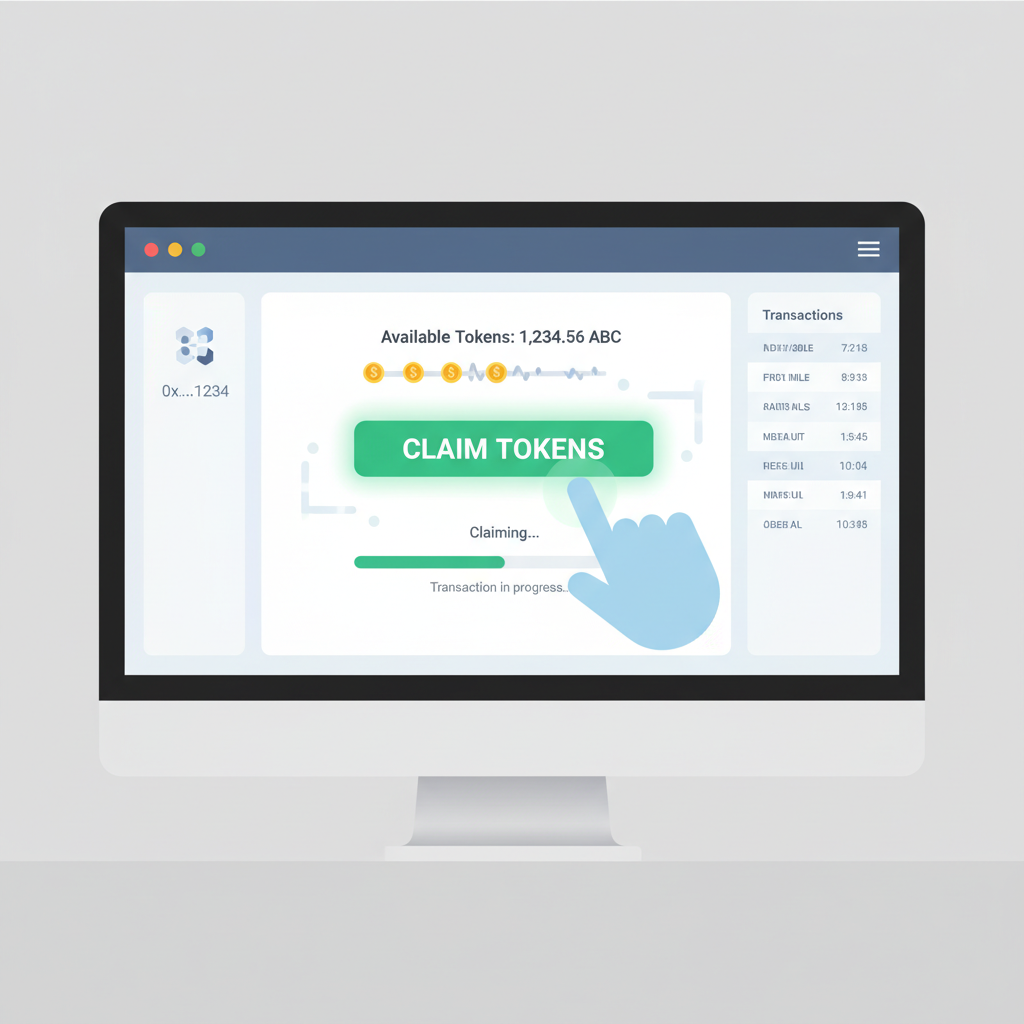

Launch demands precision. Claim testnet MON from official faucets first, ensuring wallet compatibility with Monad’s EVM fidelity. Download Kizzy mobile, connect seamlessly, and dive into prediction arenas. Bet on influencer trajectories with earned coins, prioritizing high-conviction calls over volume spam. Daily missions refresh; nail them for Purple K boosts. Referrals compound virally, injecting friends into your accrual engine. Leaderboard tracks real-time, with top tiers eyeing bulk of 6698 MON.

- Secure testnet MON via faucet drops.

- Master prediction interfaces for views/followers bets.

- Chain daily/seasonal tasks relentlessly.

- Leverage referrals for network effects.

Strategic depth emerges in Purple K optimization. Real-money games demand bankroll management akin to commodities trading: size positions conservatively, ride conviction. Seasonal levels gate advanced missions, so pace for longevity. As MON hovers at $0.004032, each token compounds testnet efforts into tangible portfolio alpha, especially if mainnet airdrops mirror activity signals.

Monad (MON) Price Prediction 2027-2032

Professional forecasts incorporating testnet momentum from Kizzy rewards, ecosystem expansion, high-performance EVM tech (10k TPS, 0.8s finality), and market cycles. Prices in USD with bearish (min), base (avg), and bullish (max) scenarios.

| Year | Minimum Price (Bearish) | Average Price (Base) | Maximum Price (Bullish) |

|---|---|---|---|

| 2027 | $0.003 | $0.020 | $0.100 |

| 2028 | $0.008 | $0.050 | $0.250 |

| 2029 | $0.015 | $0.120 | $0.600 |

| 2030 | $0.030 | $0.280 | $1.200 |

| 2031 | $0.060 | $0.650 | $2.500 |

| 2032 | $0.120 | $1.400 | $5.000 |

Price Prediction Summary

From a 2026 baseline of ~$0.004, MON is projected to grow progressively amid adoption of Monad’s performant blockchain. Average prices could 70x to $1.40 by 2032 in base case, with bullish peaks at $5 amid ecosystem booms and bull markets, while bearish floors hold above current levels assuming regulatory stability.

Key Factors Affecting Monad Price

- Testnet rewards and Kizzy leaderboard driving early engagement and token distribution

- EVM compatibility enabling seamless dApp migration and developer adoption

- Market cycles: Post-2024 bull recovery, 2028-29 bear, 2030+ supercycle potential

- Regulatory developments favoring scalable L1s with compliance features

- Tech upgrades: Ongoing TPS/finalty improvements and ecosystem grants

- Competition dynamics vs. Solana/Sui, offset by Monad’s EVM edge and incentives

- Tokenomics: Airdrops, staking (e.g., Magma), unlocks impacting supply/demand

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Elevating Your Game on the Leaderboard[/h2>

To crest the Kizzy Mobile Monad ranks, blend volume with edge. Analyze social trends macro-style: track rising accounts for follower surges, predict virality waves. Missions yield steady Purple K, but games spike volatility; winners cascade up boards. Refer three friends weekly, watch shares balloon. Monthly resets punish laggards, rewarding sustained grinders. This is Monad Momentum rewards distilled: patience fuels persistence, perspective spots inefficiencies others miss.

Macro patterns in social media mirror commodity cycles: spot the uptrends early, scale into momentum. High-conviction predictions on breakout influencers yield Purple K at rates eclipsing scattershot bets. Track seasonal multipliers via app dashboards; they can double daily hauls for top grinders. With 6698 MON on the line, equivalent to over $27 at today’s $0.004032 price, the math demands discipline over desperation.

Layer referrals surgically. Target crypto-savvy networks where friends commit long-term; one active referrer outpaces ten ghosts. Monitor Purple K velocity weekly, adjusting bet sizing as boards tighten. zkCodex’s streak rewards prove the model: persistence pays, with 10 MON drops for leaders. Extend this to Kizzy’s mobile-first arena, where touch interfaces accelerate plays over desktop dawdlers.

Risk-Adjusted Plays in Monad Testnet Rewards

No farm lacks pitfalls. Testnet tokens carry zero mainnet guarantees, yet activity signals often seed airdrops, as DappRadar guides emphasize. Overbetting erodes bankrolls in real-money games, so cap exposure at 5% per prediction, diversifying across views, followers, and engagement metrics. Monthly distributions favor Purple K concentration, but volatility spikes during viral events; hedge with mission floors. At $0.004032, MON’s 24-hour range from $0.004014 to $0.004205 signals stability, underscoring testnet’s low-risk entry to ecosystem alpha.

Portfolio integration elevates this beyond gaming. Allocate 10-20% of speculative crypto exposure to Monad testnet vectors like Kizzy, balancing with Magma staking for gMON yields. Boxmining’s strategies align: unstake periodically to fuel bets. Mitosis University’s series flags Kizzy as incentivized series part one, hinting at sequels amplifying rewards. Early Monad ecosystem participation here compounds as parallelization draws dApps, pressuring Ethereum’s throughput chokeholds.

Top users on leaderboards like zkCodex received 10 MON each; replicate via Kizzy’s Purple K dominance for 6698 MON shares.

Seasonal tasks introduce asymmetry. Level up methodically to unlock high-Purple K missions, akin to scaling into bond ladders during yield curves steepening. Referrals create flywheels: your network’s Purple K indirectly bolsters snapshots if they engage. As Monad’s 10,000 TPS beckons enterprises, Kizzy positions retail players at the vanguard, farming MON tokens leaderboard slices amid 0.8-second finality’s efficiency.

Forward positioning demands conviction. With MON at $0.004032 and testnet faucets flowing, bootstrap today. Grind missions, hunt edges in predictions, propagate referrals. Leaderboards reset monthly, but habits endure, forging paths to disproportionate Monad Momentum rewards. In a cycle favoring scalable EVM chains, Kizzy Mobile Monad delivers the leverage: strategic persistence transmutes testnet pixels into portfolio persistence.

| Purple K Strategy | Expected Yield | Risk Level |

|---|---|---|

| Missions Only | Steady Base | Low |

| Predictions and Missions | 2-3x Base | Medium |

| Full Stack (Games/Refs) | 5x and Leaderboard | High |