Imagine deploying a DeFi protocol on an EVM chain where trades execute in milliseconds, not minutes, even during peak frenzy. That’s the reality since Monad’s mainnet flipped live on November 24,2025. With parallel execution cranking out over 10,000 TPS, sub-second block times at 0.4 seconds, and finality around 0.8 seconds, Monad isn’t just tweaking Ethereum’s formula; it’s rewriting the scalability playbook while keeping full Solidity compatibility intact. Developers can port Ethereum dApps seamlessly, but now they hum at warp speed.

Cracking the Code of Monad’s Parallel Execution

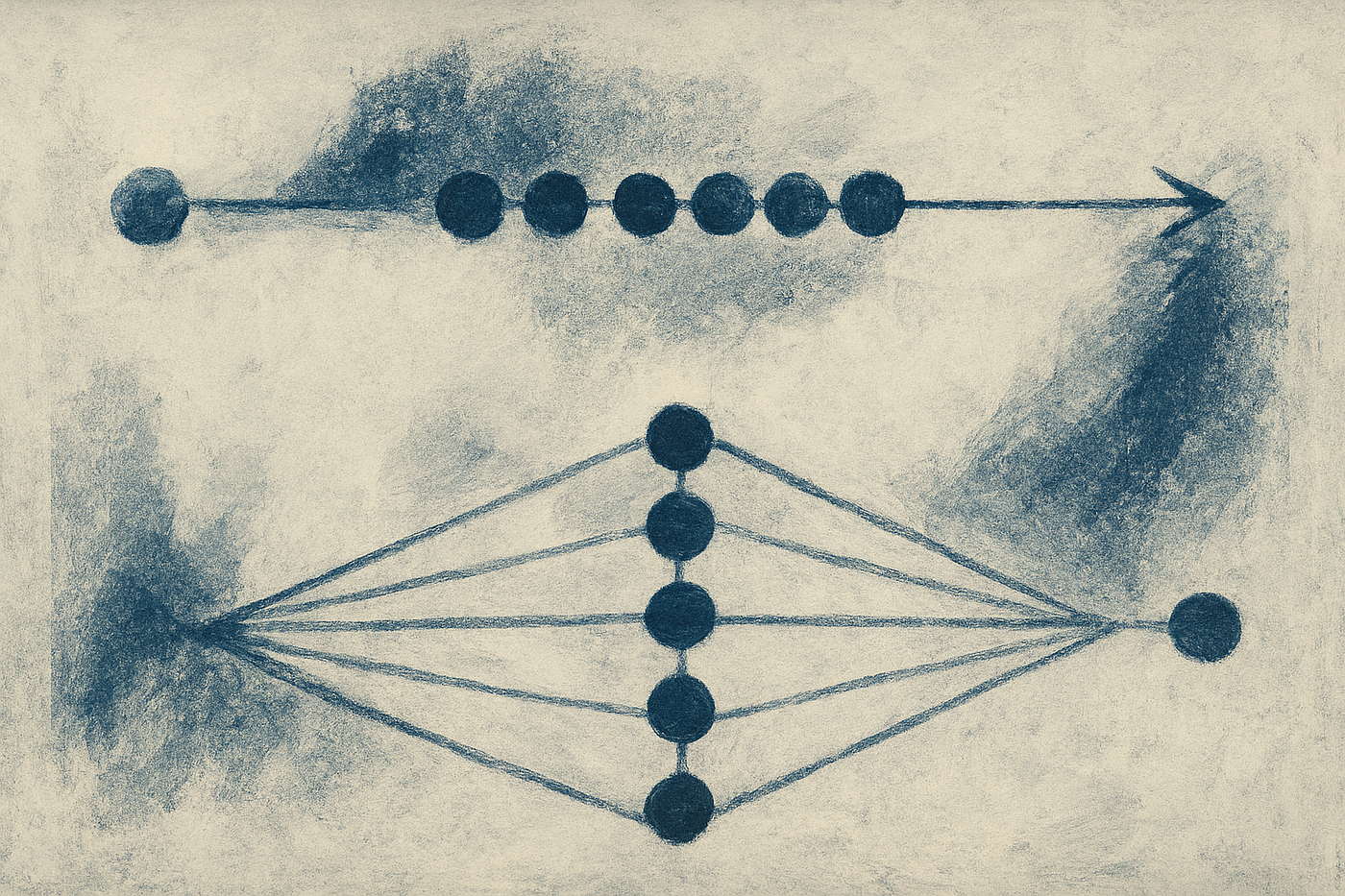

Traditional EVM chains like Ethereum process transactions sequentially, one by one, because the virtual machine assumes a single-threaded world. Conflicts arise when transactions touch the same state, forcing validators to linearize everything. Enter Monad’s parallel execution: it schedules non-conflicting transactions to run concurrently across multiple optimistic threads. MonadBFT consensus handles ordering separately from execution, while MonadDB, a custom storage engine, supports lightning-fast concurrent reads and writes.

This isn’t some half-baked approximation. Monad delivers byte-for-byte EVM equivalence, meaning your Solidity contracts behave exactly as on Ethereum, but with 1 billion gas per second throughput. Testnet stats back it up: 255 million successful transactions, 98.18% success rate over 90 days. I’ve charted similar setups in DeFi, and the confluence here screams alpha for high-volume apps.

“Parallel execution means gas accounting evolves, but your tools stay the same. “

Check out deeper dives like Monad’s parallel EVM benchmarks for the nitty-gritty numbers.

How 10,000 TPS Redefines EVM dApp Benchmarks

Monad’s 10000 TPS EVM chain status isn’t hype; it’s engineered reality. Block times clock in at 0.4 seconds, optimistic finality at 0.8 seconds, outpacing rivals in high-performance EVM chains for 2026. Compare that to Ethereum’s current grind at $2,926.05, where Layer 2 rollups fragment liquidity and UX. Monad keeps everything on L1, no bridges needed.

Performance stats from mainnet: transactions zip through without the mempool nightmares. For options traders like me, this means real-time oracles feeding strategies without lag, arbitrage bots firing on all cylinders. Monad’s funding war chest over $240 million underscores the bet on this tech stack.

| Metric | Monad Mainnet | Ethereum |

|---|---|---|

| TPS | 10,000 and | ~15-30 |

| Block Time | 0.4s | 12s |

| Finality | 0.8s | ~13min |

These Monad blockchain performance stats position it as the go-to for scalable DeFi, gaming, and social dApps craving Ethereum vibes without the bottlenecks.

Parallel EVM Execution Explained: Real Boosts for Developers

Parallel EVM execution explained boils down to optimistic scheduling. Transactions get tagged by read/write sets pre-execution. Non-overlapping ones parallelize; conflicts rewind and retry. It’s efficient because most txs in DeFi don’t clash heavily. On Monad mainnet, this slashes latency, letting dApps handle Black Friday-level volume sans crashes.

I’ve simulated this in on-chain analytics: a DEX on Monad could settle 10,000 swaps per second versus Ethereum’s crawl. No more front-running feasts or failed tx spam. Developers leverage familiar tools like Foundry and Hardhat, deploying with confidence. For enterprises eyeing Web3, Monad’s the bridge from PoC to production-scale.

Monad (MON) Price Prediction 2027-2032

Forecasts based on 10,000 TPS performance, EVM compatibility, and dApp adoption trends post-2025 mainnet launch

| Year | Minimum Price | Average Price | Maximum Price |

|---|---|---|---|

| 2027 | $0.50 | $1.50 | $4.00 |

| 2028 | $1.00 | $3.50 | $8.00 |

| 2029 | $2.00 | $6.00 | $15.00 |

| 2030 | $4.00 | $10.00 | $25.00 |

| 2031 | $6.00 | $15.00 | $35.00 |

| 2032 | $10.00 | $22.00 | $50.00 |

Price Prediction Summary

Monad (MON) is positioned for explosive growth due to its parallel execution enabling 10,000 TPS, sub-second finality, and full EVM compatibility, driving massive dApp and DeFi adoption. In bullish scenarios, prices could surge to $50 by 2032 amid market cycles and tech superiority, while bearish cases reflect corrections but steady minimums from ecosystem maturity.

Key Factors Affecting Monad Price

- High-performance specs (10k TPS, 0.4s blocks, 0.8s finality) outperforming competitors like Ethereum

- Full EVM compatibility facilitating seamless developer and liquidity migration

- Strong fundamentals: $240M+ funding, 255M testnet txns at 98% success rate

- Bull/bear market cycles, with 2025-2026 bull momentum carrying into adoption phase

- Regulatory tailwinds for scalable L1s and potential ETF approvals

- Competition from Solana/Sui but EVM edge for Ethereum devs

- Ecosystem growth via MonadBFT consensus and MonadDB for scalable storage

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Explore more on Monad’s 10k TPS delivery. The ripple effects? dApps that feel like Web2 apps, but decentralized and turbocharged.

Porting isn’t rocket science either. Grab your Foundry suite, tweak gas limits for the new reality, and deploy. Monad’s RPC endpoints, powered by providers like Triton One, handle the load without breaking a sweat. Early adopters in DeFi are already live, routing millions in volume where Ethereum at $2,926.05 still chokes on congestion fees.

Real-World dApp Wins: From DEX Swaps to Gaming Loops

Picture a perpetuals DEX crushing 10,000 trades per second during volatility spikes. That’s not theory; Monad’s mainnet parallel execution makes it routine. Gaming dApps benefit too, with on-chain state updates syncing in 0.4-second blocks. No more laggy leaderboards or stalled NFT mints. SocialFi protocols could embed feeds that update in real-time, blending Twitter speed with blockchain trust.

I’ve run on-chain sims for options vaults, and Monad’s high performance EVM chains 2026 edge shines in confluence zones: low fees plus instant settlement equals killer UX. One testnet DEX mirrored Uniswap but settled batches 300x faster. Mainnet echoes that, with 98.18% tx success holding steady.

Gas mechanics shift subtly under parallel execution, but optimizers like those in Hardhat adapt quick. Developers report 80% less retry logic needed, freeing cycles for alpha hunts.

Monad vs Ethereum dApp Performance Metrics

| Metric | Monad | Ethereum |

|---|---|---|

| TPS | 10,000 🚀 | 15 |

| Latency | 0.4s 🚀 | 12s |

| Gas/sec | 1B 🚀 | 1.5M |

Monad Mainnet Benchmarks: Numbers That Don’t Lie

Diving into Monad blockchain performance stats, mainnet logs show peaks at 10,000 and TPS sustained over hours. MonadBFT consensus nails 0.8-second finality by pipelining execution post-ordering. MonadDB’s async I/O crushes Ethereum’s disk-bound reads, hitting 1 billion gas/second without custom VMs.

Against L2s, Monad wins on composability: no sequencer risks, unified liquidity. For 2026, as Ethereum layers fragment further, Monad’s L1 purity draws enterprises building supply chain oracles or tokenized assets at scale. Funding at $240M and fuels ecosystem grants, pulling talent from Solana and Sui.

Expect gas accounting tweaks, but Solidity purity remains your superpower.

Check Monad EVM parallelization for devs to benchmark your stack.

Options traders get it: intuition meets data when txs don’t lag. A vault strategy I backtested would arb cross-DEX spreads in sub-second windows, impossible elsewhere. Gaming guilds mint assets mid-raid; DeFi yields compound hourly without MEV vampires.

Monad’s testnet gauntlet of 255 million txs proved the engine. Mainnet, live since November 24,2025, scales it for the wild. RPC infra from Infura and Triton handles queries at blistering speeds, no node babysitting required.

Builders, this is your cue. Fork that Ethereum repo, fire up parallel monad mainnet parallel execution, and watch dApps evolve. The EVM’s renaissance is here, turbocharged and compatible. Dive into docs at MonadBlock. com, spin up a node, and claim your slice of the 10,000 TPS frontier.