In the ever-evolving landscape of decentralized finance, where social sentiment often precedes price action, TrendleFi on Monad emerges as a groundbreaking platform. Live since January 19,2026, TrendleFi transforms fleeting internet narratives into tradable assets through its attention markets. Users can now speculate on social hype, events, and personalities with perpetual leverage, all verified by zero-knowledge proofs. This isn’t just another prediction market; it’s a verifiable bridge between Web2 attention data and Web3 trading efficiency, powered by Monad’s high-performance EVM chain.

Attention has long been the invisible force driving crypto markets. Bots amplify noise, viral threads spark rallies, and collective mindshare dictates trends. TrendleFi quantifies this chaos into Attention Indexes, aggregating metrics from X, Reddit, and YouTube. Traders bet on whether a narrative surges or fades, using perpetual contracts for leveraged exposure without expiration risks. Access remains exclusive via invite codes, fostering a curated community of early adopters chasing alpha in social signals.

Quantifying the Unquantifiable: TrendleFi’s Attention Mechanics

At its core, TrendleFi’s model rests on precise measurement. The platform’s Attention Index isn’t a black box; it’s computed transparently using public algorithms on verifiable data feeds. This addresses a perennial DeFi pain point: trusting off-chain oracles. By partnering with Primus and Brevis, TrendleFi ensures every index value is tamper-proof. Primus employs zkTLS proofs to fetch authentic social data directly from platforms, resistant to forgery or manipulation. Brevis’s Pico zkVM then processes this data on-chain, generating succinct proofs that anyone can verify.

Attention has always moved markets. Now it can be proven.

This zk-verifiable layer elevates prediction markets on Monad beyond speculation into reliable financial instruments. Imagine trading the hype around a Monad mainnet milestone or a viral crypto personality, with leverage amplifying gains while ZK proofs guarantee data integrity. Early market data shows strong interest, with invite-only access limiting supply and heightening demand among sophisticated traders.

Monad’s Speed: The Perfect Canvas for Social DeFi

Why Monad? As a high-performance EVM-compatible chain, Monad delivers unparalleled throughput and low latency, essential for real-time attention trading. Traditional EVM chains buckle under parallel DeFi operations like perpetuals and oracle updates. Monad’s parallel execution changes that, processing thousands of transactions per second without compromising Ethereum compatibility. For TrendleFi, this means seamless perpetual leverage trading, where positions adjust instantly to shifting social metrics.

Developers benefit too. Building on Monad unlocks dApps that handle data-intensive computations, like real-time index recalculations. Benchmarks highlight Monad’s edge: sub-second finality and gas efficiency rival centralized exchanges. In a market flooded with layer-2 compromises, Monad’s L1 approach prioritizes scalability without security trade-offs. TrendleFi’s deployment underscores this, marking one of the first major DeFi primitives leveraging Monad post-mainnet.

From a fundamental standpoint, this synergy positions TrendleFi Monad for outsized growth. Social attention precedes fundamentals in crypto; verifiable trading captures that edge. Yet risks persist: market manipulation via coordinated shilling or oracle delays. ZK verification mitigates much of this, but traders must diligence index methodologies and liquidity pools.

Perpetual Leverage Meets Verifiable Hype

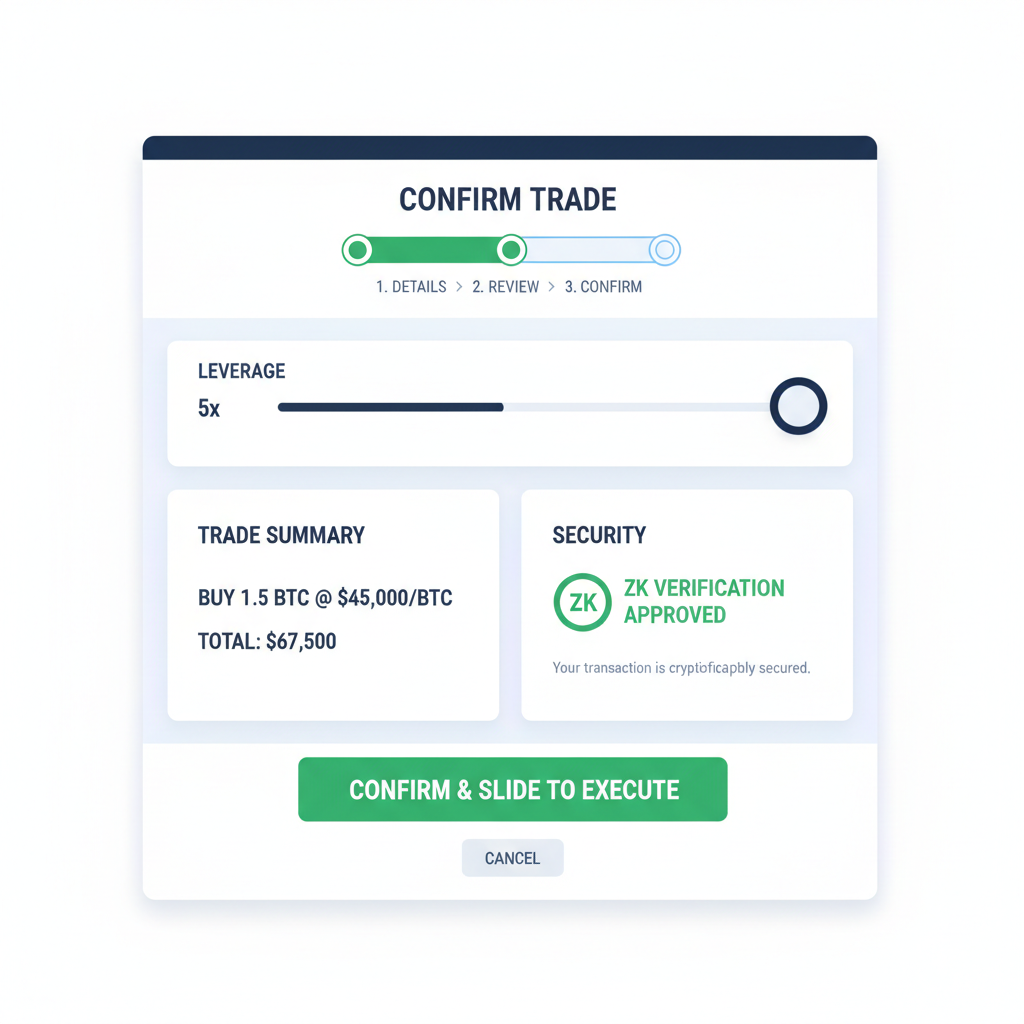

TrendleFi’s perpetuals add firepower. Unlike fixed-settlement predictions, these contracts roll indefinitely, allowing indefinite holding of bullish or bearish views on attention flows. Leverage up to 20x (depending on market depth) magnifies returns, but demands disciplined risk management. On Monad, execution is crisp; no slippage from chain congestion.

Consider a real-world example: a surging Monad narrative post-mainnet. Traders long the Attention Index, riding leverage as mentions explode. Brevis proves the computation, Primus vouches for data freshness. Settlement is trustless, payouts automatic. This model scales to any hype cycle, from memecoins to enterprise pilots, making social hype trading on Monad a new asset class.

Investor caution: while tech is robust, adoption hinges on network effects. Invite-only phases bootstrap liquidity, but broader access will test resilience. Still, with Brevis expanding ZK infrastructure to Monad, the ecosystem gains credible rails for data-heavy DeFi.

Early adopters report smooth on-chain experiences, with Monad’s parallel EVM handling perpetual rolls and ZK proof verifications without hiccups. This frictionless execution could accelerate mainstream uptake of ZK verified bets on Monad, turning social signals into portfolio staples.

From Invite to Insight: Navigating TrendleFi Markets

Entry demands an invite code, a deliberate gatekeeping tactic that mirrors elite trading desks. Once inside, the interface prioritizes clarity: Attention Indexes display real-time scores, perpetual order books show depth, and leverage sliders adjust exposure intuitively. I appreciate this design; it rewards diligence over impulse, aligning with value investing principles amid hype.

Trading flows mirror established perps platforms, but with a social twist. Select a market like “Monad Mainnet Hype Index, ” analyze the zkTLS-sourced data feed, and deploy capital. Brevis proofs update hourly, triggering margin calls or profits automatically. In my analysis, this setup favors patient traders who correlate attention spikes with on-chain volume, avoiding noise traps.

Ecosystem Milestones and Momentum

Reviewing the rollout, TrendleFi’s Monad debut caps a deliberate buildout. Partnerships with Brevis and Primus, announced late 2025, laid ZK foundations. The January 19 launch tested real-world stress, drawing praise from Azuro Protocol for its narrative-to-market conversion. Future phases promise public access, potentially flooding liquidity and sharpening price discovery in Monad DeFi prediction tools.

This trajectory echoes resilient projects: controlled launches build conviction before scale. Monad’s mainnet timing amplified visibility, as fresh throughput benchmarks drew developers eyeing data-heavy apps. TrendleFi stands out by not just riding the wave, but verifying its mechanics, a prudent hedge against crypto’s signal-to-noise erosion.

Risk-Adjusted Outlook for 2026

Fundamentally, TrendleFi perpetuals hinge on attention’s predictive power. Historical data links social volume to 20-50% of short-term pumps in mid-cap tokens; verifiable indexes could institutionalize this alpha. Yet, I temper optimism: coordinated pumps remain feasible pre-public launch, and ZK computation costs, though Monad-optimized, scale with data volume.

Monad (MON) Price Prediction 2027-2032

Scenarios based on TrendleFi adoption, ZK infrastructure maturity, TVL growth, and broader market cycles (Bear: market downturn; Base: steady DeFi growth; Bull: ecosystem boom)

| Year | Minimum Price (Bearish) | Average Price (Base) | Maximum Price (Bullish) |

|---|---|---|---|

| 2027 | $2.50 | $10.00 | $25.00 |

| 2028 | $5.00 | $18.00 | $40.00 |

| 2029 | $8.00 | $28.00 | $60.00 |

| 2030 | $12.00 | $42.00 | $90.00 |

| 2031 | $18.00 | $65.00 | $140.00 |

| 2032 | $25.00 | $92.00 | $210.00 |

Price Prediction Summary

Monad (MON) shows strong long-term potential, with prices projected to grow progressively from 2027-2032 amid TrendleFi’s verifiable attention markets, partnerships with Brevis and Primus, and Monad’s scalable L1 advantages. Base case averages $92 by 2032, bullish up to $210, assuming continued adoption and favorable market cycles; bearish floors rise steadily but remain cautious on regulatory and competitive risks.

Key Factors Affecting Monad Price

- TVL and TrendleFi trading volume growth on Monad

- ZK infrastructure maturity via Brevis and Primus integrations

- Crypto market cycles and halving effects post-2028

- Regulatory developments for prediction and attention markets

- Technological scalability and competition from other L1s (e.g., Solana)

- Mainnet performance, token utility in perpetual leverage trading

- Social attention data authenticity driving DeFi innovation

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Prudence dictates position sizing under 5% of portfolio, diversified across indexes. Monitor Primus data freshness and Brevis proof finality; any lags erode edge. Long-term, as Monad captures EVM market share, TrendleFi could evolve into a broader social hype trading Monad hub, blending sentiment with fundamentals.

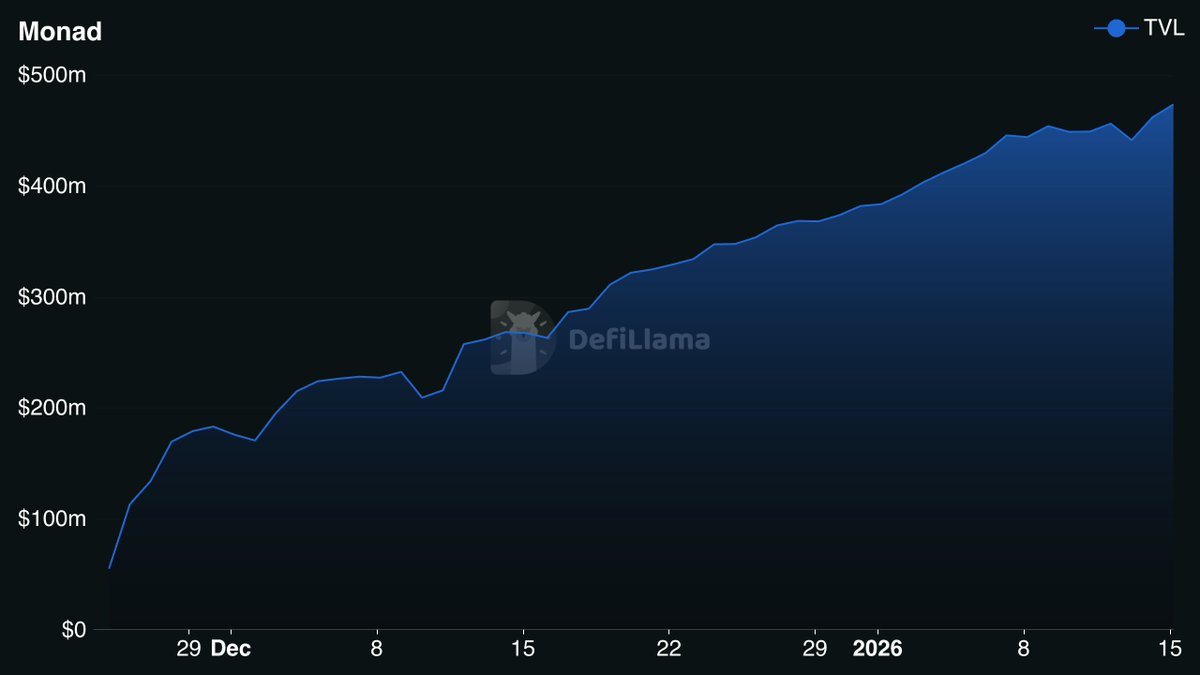

Stakeholders should track TVL inflows post-invite phase; surpassing $50M signals conviction. With zk-verifiable attention markets now live, Monad cements its DeFi frontier status. Traders equipped with due diligence stand to harvest where others chase shadows.